Many fundamental long/short hedge funds gravitate toward small- and mid-cap equities on the long side and focus on larger-cap equities on the short side. During the last three quarters of 2014, the larger cap S&P 500 meaningfully outperformed the smaller cap Russell 2000® (cumulative returns of 11.7% versus 3.7%, respectively), creating strong headwinds for investors with a portfolio long small caps and short large caps. In first quarter, that trend saw a sharp reversal as the S&P 500 returned just 1.0% while the Russell 2000® jumped 4.3%. This positive tailwind for fundamental long/short equity funds played out in results, as the Credit Suisse Long/Short Equity Hedge Fund Index (1.8%) outperformed the S&P 500 Index for the first time since fourth quarter 2012. The median manager in our US long/short equity universe also returned 1.8%.

For a select group of global macro funds, the event that set the tone for the quarter was the Swiss National Bank’s surprise decision to abandon aggressively managing the Swiss franc to a floor against the euro. The ensuing violent currency move exposed the proverbial “investors without clothes when the tide goes out.” Managers that avoided the siren call of positive carry missed losing money; those with counter-trend positions did very well; those with significant positive carry positions, short the CHF and long EUR, suffered. Indeed, the sharp reversal led to the high-profile closure of two prominent discretionary macro hedge funds, COMAC and Everest.

Turning to diversifying hedge fund strategies more broadly, the favorable environment that boosted these strategies in late 2014—particularly quantitative strategies like trend, momentum, and systematic macro—continued in first quarter 2015. Systematic macro strategies that were positioned for several “breakout” moves, and avoided positive carry trades, generally did very well, validating their portfolio role. Among the quant futures funds that we follow, on average the group returned almost 7% for the quarter with a range of -1% to 14%. Trend followers averaged about 8%, ranging between 0% and 15%. Fixed income relative value, volatility, discretionary global macro, and multi-asset GTAA managers that we follow all produced on average, as a group, a more muted sub 2%. The potential for “events” in 2015—a rise in the Federal Funds rate, a “Grexit,” a reversal in the upward trend of the US dollar and US equities, a bounce in the Euro Stoxx, events in the Middle East or Ukraine—all point to greater opportunities for volatility and returns for appropriately positioned managers.

A Look At Energy

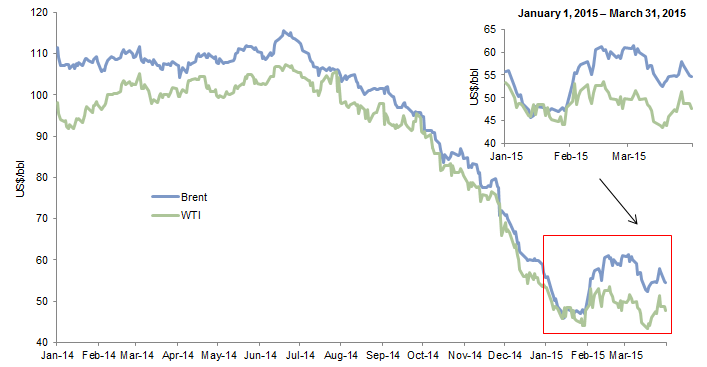

Of course the other story of first quarter was the continuing fall in oil prices in January and their subsequent stabilization mid-quarter around $50-$60 per barrel. Across the spectrum of the fundamentally based managers and strategies that we cover, managers, generally speaking, tend to avoid making any type of directional bet on energy prices. With that said, great investors take advantage of dislocations, so we were not surprised to hear that many of the managers we follow spent time looking at the space. Ultimately, the drop in oil prices does not appear to have created tremendously compelling opportunities on the long side as managers added only marginal exposure across the energy universe (as they wait for strong-positioned companies to see greater price movements). Most new long exposure focused on companies within the energy complex that traded down in sympathy with oil prices but had a business totally unrelated to oil prices (except, perhaps by name or GIC code). Many managers continue to find compelling short themes within the energy sector.

Source: Thomson Reuters Datastream.

As a result of the sharp decline in oil prices generally—and the price of gas specifically—we did see some managers put capital to work in a second derivative play. Managers theorized that lower gas prices provided a tailwind to the US consumer, and as a result, exposure to the consumer discretionary space increased. Many managers particularly focused on the lower-end consumer (dollar stores, for example), expecting that the tailwind from lower gas prices would most benefit that market segment.