The same quiet economic and financial environment, with strong equity markets, that muted returns for hedge funds in the first quarter continued during the second. While the US stock market rallied almost 5%, the yield on the US ten-year dropped 20 bps and the yield curve essentially moved in parallel. Not surprisingly, the VIX declined from 13.9 to 11.6. The quarter saw few dramatic moves or surprises. In China, as President Xi Jinping moved against the shadow banking system and corruption, the renminbi weakened just as the first quarter was ending, whipsawing a number of hedge funds that had bet on the usual gradual pegged strengthening. While some still believe that the reforms will lead to some sort of systemic “event,” the more likely outcome will be greater financial discipline reinforced by a few exemplary failures.

Oddly, geopolitical events such as the Russian (re)annexation of Crimea, the continuing civil war in Syria, and the budding breakup of Iraq have so far had little impact on markets. Central bank officials have polled hedge funds for their reactions to “what if?” scenarios and, in most cases, the consensus is that any serious event would lead to a “flight to quality”: rallying yield curves and a strengthening of G-3 currencies.

Returns

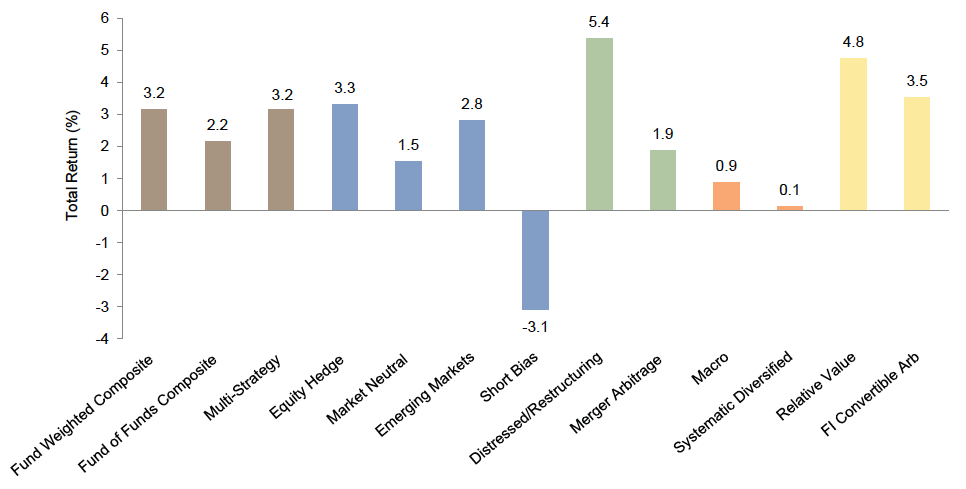

Year-to-date through June 30, hedge funds as a group have generated underwhelming returns, particularly when compared to broad-based equity markets indexes (all returns in US$ terms). Various sources show hedge funds as a group up about 3% through June 30, with a healthy dispersion of returns across strategies and geographies.

The lack of strong trends and, in the case of Japan and China, the reversal of trends had a generally deleterious effect on discretionary global macro managers; returns for a select group of funds we follow ranged from -5.6% to 3.9% for the quarter. Trend following, risk parity, and systematic blend managers had somewhat better returns, ranging from -2.1% to as much as 7.4%. The “risk-off” and benign rate environment helped multi-strategy funds with a credit bias as well as most dedicated credit funds, the range being flat to up 5.4%, with an average of 2.8%. This is also a reflection of the continuing retail demand for high-yield bond funds. Macro managers with a fixed income bias suffered from the lack of volatility, generating

-1.0% to 4.0%.

Equity-focused and event-driven funds also had a challenging first half of 2014. Based on preliminary data the HFRI Equity Hedge Index has returned 3.3% through June 30, meaningfully lagging the 7.1% return for the S&P 500 and the 6.5% return for the MSCI All Country World Index. Performance for equity-focused funds has lagged in part because of the market rotation that occurred away from growth and into value that we discussed in our first quarter update. Another factor contributing to weak relative performance is managers growing more cautious as the market has continued to climb to higher levels despite all of the geopolitical and social flashpoints mentioned earlier. Looking forward, we continue to be optimistic about the prospects for event-driven managers given continuing corporate activity and for managers that opportunistically invest across capital structures.

Source: Hedge Fund Research, Inc.

Note: Hedge Fund Research data are preliminary for the preceding five months.

Launch Environment

Following a multi-year bull market across most asset classes, the accelerating pace of new hedge fund launches isn’t surprising. While a complete perspective of the hedge fund landscape is hard to obtain, data from Morgan Stanley show that 2013 saw more new launches than at any point in the past four years.

The current launch environment is interesting for a number of reasons. First, the number of funds that are willing to accept (or require) strategic capital—capital that is provided early in a fund’s life in exchange for preferential terms or a piece of the business—has steadily declined since 2011. In 2011, 52% of Morgan Stanley’s universe of new launches accepted strategic capital, but that rate has declined in each of the last three years (49% in 2012, 38% in 2013, and 31% through April 2014). Digging into the data a bit further shows that at the same time the number of strategic deals is declining, the average deal size is meaningfully increasing. In 2011, only 15% of strategic investments exceeded $200 million, while through April 2014 40% of strategic investments have reached that mark.

Second, the current launch environment has created a “have” and “have not” dynamic across the hedge fund industry. Specifically, the importance of launching with critical mass has been amplified over the 2010–14 timeframe. Of funds in Morgan Stanley’s universe that launched with less than $100 million in that period, only 38% currently have assets exceeding $100 million. Funds that launched with over $100 million in the same time frame now, on average, have assets under management of over $500 million.

Finally, a very small and select group of hedge funds has been able to raise sizeable amounts of capital (in the $1 billion range) from a handful (numbering in the twenties) of investors. This select group of funds has been able to raise the desired amount of capital on day one and stop marketing after launch. In addition to having a meaningfully different experience raising capital than the average fund, these funds were able to raise much longer duration capital (some funds have been able to raise three- or five-year capital). In some ways this period reminds us of the 2006–07 timeframe for launches as we have started to hear the phrase “oversubscribed” again.

Going Forward

The second quarter saw central bank policies, on which so many hedge funds depend, finally start to diverge. In the United States, the Federal Reserve has begun to signal that the pace of securities purchases will decline as the economy and, most importantly, employment start to rebound. Indeed, the growth numbers improved from an exceptionally cold winter, pointing to over 2% growth for the calendar year. Crucially for Fed policy and confirming the pace of the rebound, unemployment reached its lowest level (6.1%) since 2008. Barring a sharp reversal, every pundit now predicts when, and not if, QE will end and short-term rates will rise.

Meanwhile, President Mario Draghi has signaled that the European Central Bank will maintain easier policy for the foreseeable future, with even the possibility of an expanded mandate for securities purchases. And, in the most aggressive stance of the major central banks, the Bank of England intends to tighten and is considering dampening the housing market (bubble?) with punitive measures on speculative new UK mortgages. The oft-watched and imitated (although tiny) Reserve Bank of New Zealand is also in aggressive tightening mode. Finally, the People’s Bank of China is moving to clamp down on its own shadow banking system. The upshot is that central bank policies are becoming less uniform as some economies emerge from the global financial crisis, which has ramifications for the yield curve shapes and currencies on which many macro-oriented hedge fund strategies depend. While it is far too early to proclaim the long-awaited death of exceptionally low volatility, there are some hopeful signs. For the first time since 2003, the Bank for International Settlements ominously cautioned that central banks might need to raise rates sooner to prevent asset bubbles. That view prompted immediate and almost unanimous disagreement from the European Central Bank, the Fed, the Riksbank, and even the Bank of England.

Japan’s Abenomics, the source of some spectacular macro returns in 2013 (short the currency and long the stock market), may again deliver if the world’s largest pension, the GPIF, finally moves out of Japanese government bonds and into foreign and domestic equities. Unfortunately, the market’s anticipation of this shift and the GPIF’s slow bureaucratic pace will likely give any major market movements all the breathtaking speed of a Noh play.