Investing in revenue development and fundraising while simultaneously pursuing goals for asset growth is a balancing act. Public universities commonly draw from a combination of three funding sources—the university’s centralized operating budget, gift fees, and administrative fees charged against the endowment—to help pay for the growing costs of development efforts. However, determining the right mix for an institution inherently involves trade-offs.

- Development efforts conducted at public universities rely most heavily on central operating budget funding. Efforts to increase development funding may compete for funding with other departments and offices

- Administrative fees charged against the endowment are the primary source of development funding at affiliated foundations. These fees add to the annual endowment distribution and need to be balanced with spending policy in support of university operations and intergenerational equity

- Fees on new gifts can augment fundraising resources, but are less common. Though they reduce reliance on operating budget and the administrative fee, gift fees can challenge donor expectations and gift designations

Fundraising for public universities has come into increased focus in recent years as other traditional sources of revenue remain flat or even decline. As the fundraising efforts at these universities continue to grow in scale and cost, paying for these efforts can strain the investment portfolio, the university’s operating budget, or both. This paper outlines the various funding mechanisms public universities can use to pay for development efforts, and the implications they have on the investment portfolio and enterprise as a whole.[1]In this paper, “fundraising” and “development” are used interchangeably to refer to the broad set of activities around soliciting, collecting, processing, and stewarding gifts and bequests to … Continue reading

Financial Pressures Continue for Public Universities

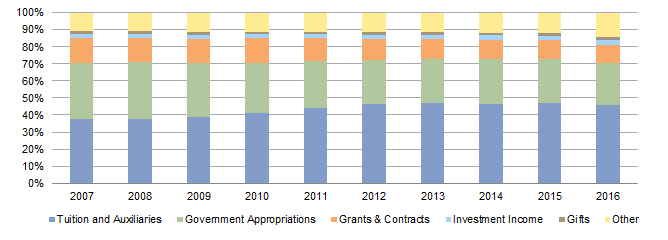

In the aftermath of the global financial crisis, the share of public university revenues from government appropriations fell markedly, from an average 33% in 2008 to 26% in 2012, and then remained flat until 2016, when it fell another 1% (Figure 1). Reliance on revenue from students and their families grew to fill the void, from an average 38% in 2008 to 47% in 2012, and then similarly stayed flat through 2015 before falling 1% in 2016. With limits to growth in government appropriations and tuition revenues in the current environment, demands on other revenue sources—particularly investment income and gifts—to fund operations are growing.

Source: Moody’s Investors Service.

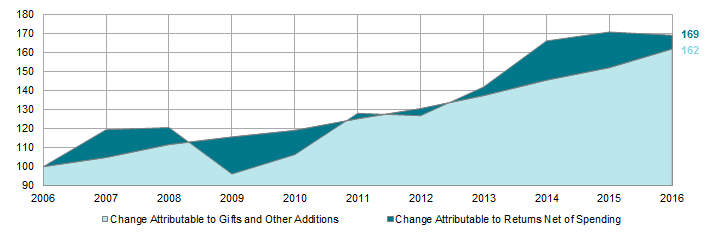

Gifts are a relatively small source of operating revenue at 2% on average, but new gifts and other additions to the endowment have been the primary driver of portfolio growth for public universities over the last ten years (Figure 2). This highlights how critical successful fundraising efforts are to funding university spending. The impact of fundraising efforts in supporting the institution varies by the type of gift raised. Funds raised for current year use can cover annual budget gaps, making a more immediate and direct impact on the institution. Funds raised for the endowment often have a rather muted short- or intermediate-term impact, but a more lasting long-term impact by adding to the institution’s permanent capital, which will better support the institution in perpetuity. New gifts for buildings and capital projects can bring visible additions to a university campus, potentially increasing the university’s appeal but adding new costs.

Figure 2. Ten-Year Cumulative Change in Endowment Market Value for Public Universities

Years Ended June 30 • Base Year July 1, 2006 = $100 • US Dollars

Source: College and university data as reported to Cambridge Associates LLC.

Notes: Analysis displays the average cumulative growth in endowments for public institutions over the last decade based on an initial $100 investment at the beginning of the period. Included are 28 public institutions that provided returns, effective spending rates, and endowment market values for each year from 2006 to 2016.

Different Funding Mechanisms

A challenge moving forward will be managing the costs of scaling up fundraising efforts and determining how these costs are funded. Unlike at private universities, where fundraising efforts are largely paid from one source (the university’s centralized budgeting process) at public universities the costs for development efforts are commonly funded from some combination of three different sources: the centralized operating budget, gift fees, and administrative fees.[2]Our analysis in this paper is derived from Cambridge Associates’ 2016 Development survey, administered to 50 public universities, public university–affiliated foundations, and private … Continue reading For the public institution (public universities and public university–affiliated foundations) respondents in our survey, 80% indicated using an administrative fee to fund a portion of or all of their development efforts, while 50% indicated using the centralized operating budget and 20% indicated using some form of gift fee as a means of funding their development efforts.

Centralized Operating Budget. The first mechanism for funding development efforts is to include the cost in the university’s centralized operating budget, which funds all departments and offices, including development. The position of fundraising in the organization informs the degree to which fundraising is paid for from the central budget. Development activities conducted solely at the university tend to rely more heavily on funding from the university’s operating budget, whereas development activities conducted through an affiliated, but separate, foundation tend to rely less on the university’s central budget for funding.

Gift Fees. The second mechanism for funding development efforts is to levy a fee (sometimes referred to as a “tax”) on new gifts. These fees can be levied on gifts for the endowment, capital projects, and/or current year use. Although not frequent, those who assess gift fees do so on endowment gifts only. The fee is assessed in one of two ways: either by taking from the principal of the gift upon receipt or “taxing” the distribution from the gift during the first year(s) in which it is incorporated into the investment portfolio’s spending policy calculation. The latter option, “taxing” the distribution, was cited by only a few institutions, with the former, taking from the principal of a gift, more common among those assessing fees. Although gift fees are not commonly employed overall, a handful of participants in our survey noted they are considering implementing a gift tax policy.

For more detail on the different fundraising models for public universities, see Tracy Filosa, Grant Steele, and Geoffrey Bollier, “Fundraising and Endowment Oversight for Public Universities,” Cambridge Associates Research Note, July 2015.

Administrative Fees. The third mechanism for funding development efforts is through the use of an administrative fee charged against the endowment. This represents a separate charge against the endowment in addition to the annual spending policy distribution already used to support university operations. In other words, an administrative fee to cover a portion, or all, of the costs for fundraising[3]In addition to fundraising, the administrative fee can also be used to cover costs for investment management, other minor revenue-generating activities, or some combination of all three. Some … Continue reading adds a second spending requirement on the investment portfolio, which may impact investment return objectives and spending policy.

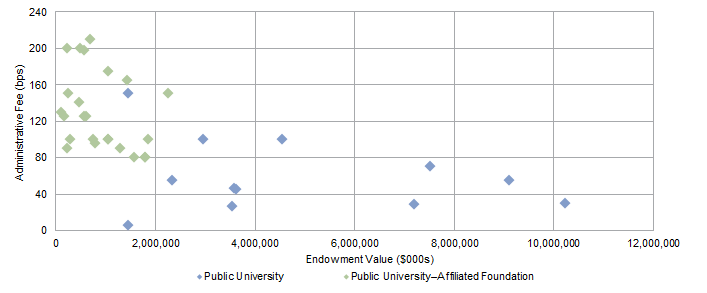

There is an inverse relationship between the administrative fee charged against the endowment, measured in basis points, and the overall size of the endowment assets—as the size of the investment portfolio increases, the rate of the administrative fee charged against the endowment tends to decrease (Figure 3). This is unsurprising, since for any given fee rate a larger endowment will generate more money to fund development than a smaller endowment. Thus capital campaigns, which tend to come with additional costs, can pay for themselves if they are successful in raising funds for the endowment.

Sources: Cambridge Associates 2016 Development survey and 2016 College & Universities Investment Pool Returns survey.

The size of the administrative fee also depends on who primarily conducts the fundraising activities on behalf of the university. The administrative fee charged against the endowment tends to be higher for public universities that use an affiliated foundation to conduct development activities. The fee rate is lower at universities where those functions are conducted within the umbrella of the university’s operations.

To a lesser degree, the size of the administrative fee charged against the endowment can also depend on whether the fee is also used to cover the internal investment oversight costs of the institution. Where the administrative fee is used to cover the costs of investment management in addition to fundraising, the total administrative fee is higher, though the portion of the overall fee used to cover investment oversight costs is usually relatively small.

Finding the “Right” Balance: Operating Budget vs Administrative Fee

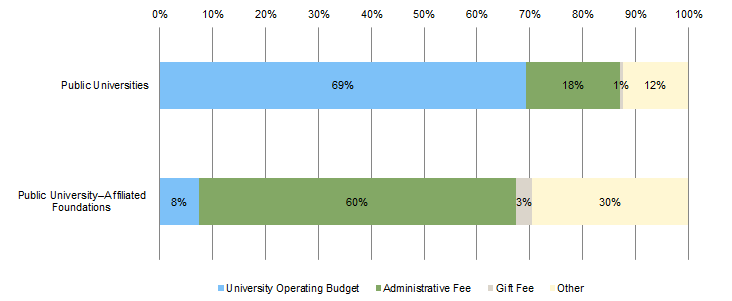

The balance between different funding sources looks very different for public universities and public university–affiliated foundations. On average, the university’s operating budget funds over two-thirds of development costs for the group of public universities, and the administrative fee funds the majority (60%) of development costs for the group of public university–affiliated foundations (Figure 4).

Source: Cambridge Associates 2016 Development survey.

Note: Examples of what is included in Other are funding from the state budget, income from cash holdings or other unrestricted (non-endowment) funds, current year gift funds, and additional agreements with the university or affiliated entities.

Determining the “right” mix for an institution inherently involves trade-offs. The amount of funding from the operating budget for various departments and programs partly reflects the institutional priorities of the university. Although the size and scope of development efforts may compose only a small fraction of the university’s overall operations, increasing funding for development requires either reallocating the current budget or growing the size of the budget altogether. Within the confines of the current budget, shifting funding from one department to another inevitably leads to difficult decisions. Increasing funding for development via budget growth could come from increased endowment spending and/or new endowment gifts that would grow the endowment’s distribution to the budget. Though donor-restricted gifts are not commonly designated for development efforts, increasing revenues from the endowment could raise the budget as a whole and free up additional funds for development. Growing advancement funding by increasing the endowment spending policy rate could erode permanent capital more quickly, and thus may not be sustainable over the long run.

Alleviating pressure on endowment spending by shifting to a greater reliance on an administrative fee presents different trade-offs. Adding an additional fee on top of the policy distribution adds to the overall annual spending burden that must be met by the investment portfolio. Coordinating the endowment spending policy rate with the administrative fee rate will help inform what a sustainable total spending rate over the long run should be.

Operating Budget vs Administrative Fee: An Example

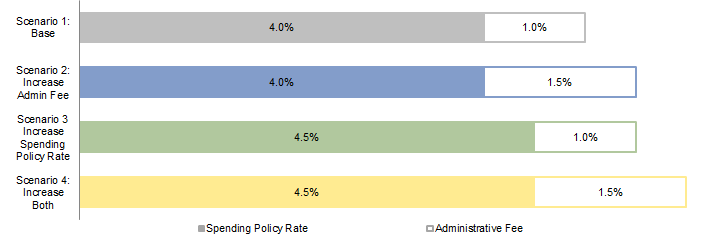

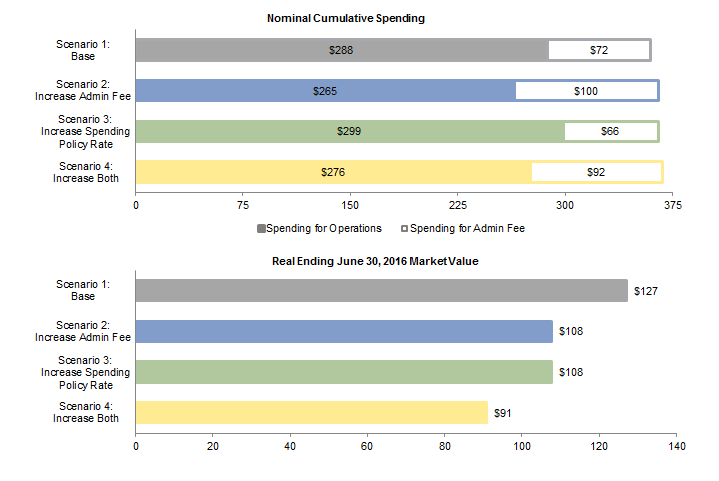

To better illuminate the trade-offs between relying more heavily on the operating budget (i.e., spending policy distribution) versus an administrative fee, we model the impact on spending and endowment market value under four different scenarios for applying a spending policy rate and administrative fee to a hypothetical $100 million portfolio over the past 30 years.[4]Returns are based on a portfolio composed of 70% MSCI World Index and 30% Bloomberg Barclays Government/Credit Index, and the fund is rebalanced annually. Inflation is applied using the Consumer … Continue reading Scenario 1 is considered the base scenario: a 4% spending policy rate with an additional 1% administrative fee. Scenarios 2–4 offer different ways to gain more funding for development: increase the administrative fee (Scenario 2), increase the spending policy rate (Scenario 3), or increase both (Scenario 4).

Figure 5 summarizes these four spending scenarios and Figure 6 displays the cumulative endowment spending and market value growth under each one.

Source: Cambridge Associates LLC.

Figure 6. Cumulative Endowment Spending and Market Value Growth Under Various Spending Scenarios

Fiscal Years 1986–2016 • US Dollar (millions)

Source: Cambridge Associates Endowment Spending Model.

Notes: All scenarios assume a starting endowment value of $100 million on June 30, 1985. All scenarios use a market value–based spending rule with the policy rate applied to a trailing 12-quarter average market value. The administrative fee is applied to the average market value over the same trailing time period.

Scenarios 2 and 3 result in the same total spending and endowment market value at the end of the time period, but present a trade-off between spending for operations and the administrative fee. Scenario 2 provides more immediate funding for development, since spending from the administrative fee is primarily used to fund development efforts directly. The trade-off in Scenario 2 is lower spending for operations, affecting the funding levels for other programs. Scenario 3 has the opposite effect: increased spending for operations raises the university’s budget, possibly allowing for additional “fungible” dollars to support development efforts. However, increasing the spending policy rate, while keeping the administrative fee at the same level, decreases the direct funding for development.

Scenario 4 spends the most overall, although the spending on each component is less than the scenarios where only one component is increased, as the overall higher spending rate erodes the purchasing power of the endowment. If an institution needs to draw additional funding for development from the endowment, it may get more “bang for the buck” by raising either the spending policy rate or administrative fee, but not necessarily both.

Gift Fees: An Alternative Option?

With the goal of ensuring intergenerational equity for the investment portfolio, an institution may consider the use of gift fees as a source of funding for development. Though funding from gift fees remains a small proportion of the overall funding for development, as shown in Figure 4, the primary benefit of using gift fees is that they can alleviate some of the pressures of over-reliance on the other sources of funding, particularly the endowment. The use of gift fees can cultivate a “pay for itself” philosophy by tying the funding for development efforts to the success of increased fundraising results. An increased use of performance-driven funding can lead development offices to find efficiencies at the university level and potentially across campuses as development operations grow.

For more on options for underwater endowments see Tracy Filosa, “Keeping Underwater Endowments Afloat (And the Programs They Support),” Cambridge Associates Research Note, August 2016.

However, introducing and applying gift fees does not come without challenges. For endowment gifts in particular, a policy of “taxing” a new gift and/or the distribution from a new gift must be clearly identified in the gift acceptance and investment policies governing the management of the university’s gifts and endowment assets. Such fees could cause friction with donors, particularly those whose gift has been restricted for a designated purpose. An upfront fee signals to donors that not all of the amount of their original gift will be used for its designated purpose, and a “tax” on the distribution from a new gift will also result in spending from the donor-restricted gift outside its donor-specified purpose.

The timing of gift fee implementation is important. Implementing a gift fee on new endowment gifts during a market decline, or even a period of flat market performance, could immediately cause a new endowment to fall “underwater” (below its principal value). Poor timing in implementing a new gift fee policy could hinder the endowment’s distribution and growth right out of the gate.

Conclusion

For more detail on the net flow rate and total portfolio growth, see Ann Bennett Spence, Tracy Filosa, and Billy Prout, “The Missing Metric for Endowment Growth: Net Flow Rate,” Cambridge Associates Research Note, November 2014.

Investing in revenue development and fundraising while simultaneously pursuing goals for asset growth is a balancing act, particularly when the institution is dependent on distributions from the endowment to fund the revenue development efforts. The overall math for achieving real asset growth must factor in not only new additions to the endowment, but also investment performance and total spending from the endowment, inclusive of both the spending policy distribution and the administrative fee. Together, these factors compose the institution’s net flow rate.

Ultimately, there is no “one-size-fits-all” solution for the appropriate mix of funding for development. Asking the following questions can help guide discussions around what the right balance in funding for development might look like:

- Does the university’s operating budget have “flexibility” such that prioritizing funding for development activities will not take away funding from other mission-critical programs and activities?

- Does the current level of funding, from all sources in aggregate, allow for growth in the scale and scope of fundraising efforts?

- Would increasing the administrative fee, or adding a fee where one is not currently in place, place an undue burden on the investment portfolio given the combination of the current spending policy requirements and recent performance results? Would adding an administrative fee, or increasing an existing fee, compromise intergenerational equity and the long-term impact of the endowment?

- If a gift fee is not currently used, would implementing one allow for lowering the development funding requirement from other sources? Would implementing a gift fee policy deter donors from giving, particularly if donors feel their gift has been diverted away from their designated intent?

Finding the “right” mix of funding will require conversations between the investment, finance, and development committees to balance current budget priorities with long-term financial sustainability. They will need to weigh the portfolio and enterprise implications of altering the current funding structure, or relying too heavily on one source, while at the same time supporting the university’s revenue-generating development efforts.

Tracy Filosa, Managing Director

Geoffrey Bollier, Associate Investment Director

Footnotes