Approximately 85% of participants in this year’s survey were private nonoperating foundations. These types of foundations are required to make qualifying distributions that amount to approximately 5% of their asset value every year. They function primarily as grant-making organizations, providing funding and support to other charitable organizations. This section summarizes responses for this cohort of private nonoperating foundations.

The IRS-mandated formula for determining the amount qualifying distributions is based on a foundation’s average asset value over the course of the tax year. It is also important to note that not all spending for a foundation satisfies the IRS requirement. For example, certain kinds of administrative expenses—such as those spent on investment oversight—do not count as qualifying distributions. The payout rate in this study differs because it is calculated as a percentage of the portfolio’s beginning-year market value and includes all spending from the portfolio, not just qualifying distributions for tax purposes.

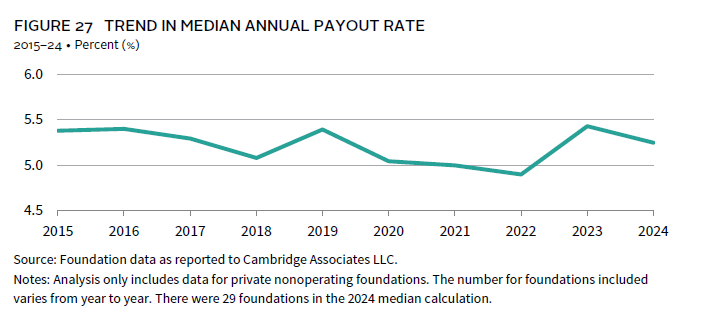

The median payout rate for participating foundations was 5.3% in 2024 (Figure 27). This was just slightly lower than the median of 5.4% from 2023. Results were similar when looking at actual spending dollars for foundations that reported data over the last two years. Exactly half of this group reported an increase in spending from the portfolio in 2024, while the other half reported a decrease.

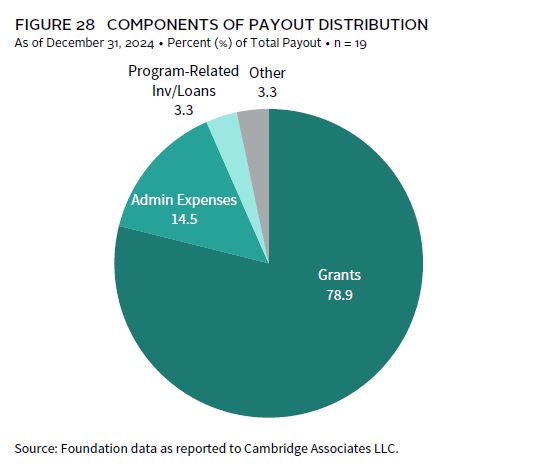

Grants are the single largest component of annual payout for foundations. On average, grants made up 79% of spending from the portfolio in 2024 (Figure 28). Administrative expenses were the next largest component of foundation spending, representing about 15% of total payout. The remaining portion of payout consists of program-related investments and other types of miscellaneous spending. This average breakdown is nearly identical to last year’s.

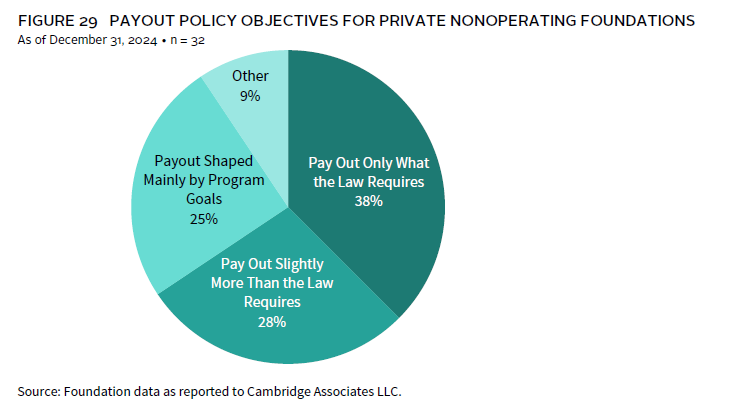

A majority of foundations that provided information about their payout objective indicated that their objective was to either meet the minimum IRS requirement or slightly exceed that amount. Another 25% had an objective shaped mainly by program goals, while 9% reported their objective was something else or a combination of the aforementioned objectives (Figure 29). With the 5% payout requirement being such an influential factor on foundation spending, we find that there is not widespread use of an endowment-type spending rule among our survey group. Just 28% of respondents indicated that they use a multi-year smoothing period to calculate annual spending. The payout rates cited by this group of foundations ranged from 5% to 5.5%.