Communities of entrepreneurs and engineers are establishing themselves in cities around the world, with the press labeling cities from Chattanooga to Tel Aviv the “next Silicon Valley.”[1]A phrase that has been in use for a surprisingly long time. According to Google Ngram, the first instance of the term “next Silicon Valley” used in a book occurred in 1984. Los Angeles, well known as the home of Hollywood and endless summers, also supports a robust tech ecosystem. However, compared to other regions, the supply of venture capital to finance tech enterprises in Los Angeles is scarce relative to the number of investment opportunities. LA-located “unicorn” companies like Snapchat and SpaceX are well known and well capitalized, but Southern California’s market has more to offer. Los Angeles has developed an ecosystem of technical talent surrounded by a growing and supportive community, which generates a positive feedback loop and causes the ecosystem to become increasingly productive as it scales. What it’s missing is a linkage to capital, which is where the investment opportunity may lie.

While idiosyncratic local market conditions should not drive investment decisions (indeed, we have emphasized the overwhelming importance of manager selection in alternative asset classes), the market environment in Southern California[2]In this brief, we use Los Angeles and Southern California interchangeably, as we do with Northern California, the Bay Area, and Silicon Valley. will provide a tailwind to high-quality venture capital (VC) managers focused on the region. The roster of institutional venture managers in Los Angeles is somewhat thin, but several local general partners are showing promise and the roster of high-quality venture managers located outside the area but targeting investments there is growing. Investors looking for a niche opportunity in an area that appears undercapitalized may wish to consider venture funds looking to deploy capital in Los Angeles.

Measuring the Ecosystem’s Quality

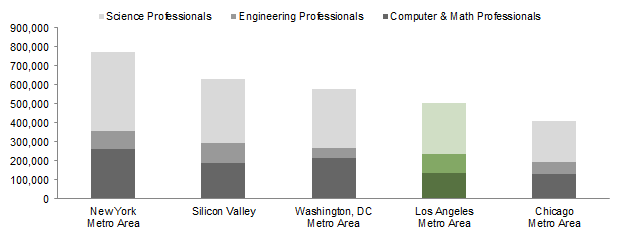

Keystone Species: Technical and Entrepreneurial Talent. Technical and entrepreneurial talent is abundant in Los Angeles, home to more technical professionals[3]The term “technical professional” here refers to those employed in science, engineering, or computer and math professions. than almost anywhere else in the United States. According to 2013 Census data for metropolitan areas, Los Angeles had the fourth highest population of technical professionals in the country, next to Washington, DC; Silicon Valley; and New York. On a per capita basis, Silicon Valley still has far more technical professionals than Los Angeles, but Los Angeles surprisingly exceeds New York. Entrepreneurial talent in Los Angeles is abundant as well. According to the 2015 Kauffman Index of Entrepreneurial Activity, Los Angeles is in the top five cities for start-up activity, beating both San Francisco and New York.

Sources: US Census Bureau, 2013 American Community Survey 5-Year Estimates, Table C24010 and US Census Bureau, 2013 American Community Survey 3-Year Estimates, Table B24010; generated using American FactFinder, factfinder2.census.gov, August 12, 2015.

Notes: Data are at the Metropolitan Statistical Area level as defined by the US Office of Management and Budget and referenced by the US Census Bureau. Silicon Valley represents the combined San Jose and San Francisco MSAs. Our categorization of Science Professionals excludes “architects, surveyors, and cartographers” and Engineering Professionals excludes “social scientists and related workers,” as identified on Table B24010 of the 2013 American Community Survey 3-Year Estimates.

Source: Kauffman Foundation, 2015 Kauffman Index of Entrepreneurial Activity, Table 1, June 2015.

Notes: The Kauffman Index: Start-Up Activity is a broad index measure of business start-up activity in the United States. The index is calculated by equal-weighting three normalized measures of start-up activity as calculated by the study: (1) rate of new entrepreneurs among the US adult population, (2) opportunity share of new entrepreneurs (defined as the percentage of new entrepreneurs primarily driven by “opportunity” vs by “necessity”), and (3) start-up density (new employer businesses less than one year old, normalized by population).

Southern California has a history as a center for manufacturing and aerospace engineering, and Los Angeles continues to graduate a large number of engineers from schools like CalTech, Harvey Mudd, and UCLA. As a result, Facebook, Google, Microsoft, Yahoo, and other major tech firms have established a meaningful presence in Los Angeles to take advantage of the local pool of talent. Although Silicon Valley remains the obvious choice for “migrant entrepreneurs,” or people who move to a new city to start a business, LA’s brand is improving. Most young web developers are familiar with applications like Snapchat, Tinder, or any of the seven companies on the Wall Street Journal’s Billion Dollar Companies list that are based in Southern California.[4]In addition to Snapchat, as of March 2015 the list includes Fisker Automotive; Honest, Co.; JustFab; Legendary Entertainment; Razer; and SpaceX. This kind of brand recognition matters to founders who need to attract the best and the brightest to work at their companies. Hiring conditions are advantageous for founders as well: according to data collected by Jones, Lang, LaSalle, IP, Inc., tech worker wages are lower in Los Angeles than in Silicon Valley, which is an additional tailwind for founders and investors.[5]Jones Lang LaSalle, IP, Inc., “High-Technology Office Outlook,” United States, September 1, 2014. As LA-located engineers and technicians leave major tech firms to launch companies of their own, and as migrant entrepreneurs make their way to Los Angeles, a self-reinforcing cycle may take hold that would see the local talent base continue to improve.

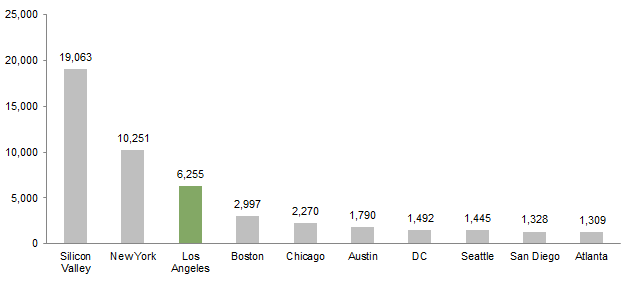

Surrounding Community: Tech Firms and Hollywood. Until recently, LA’s tech community appears to have lacked a center of gravity. Successful venture professionals were scarce, and several local VC firms had ceased operations over the past few years. Now, prominent entrepreneurs are contributing to a vibrant tech ecosystem in Los Angeles. Some established entrepreneurs in the city have made a commitment to improving LA’s start-up infrastructure by funding local accelerators and focusing attention on LA’s promise as a tech hub. As already discussed, major tech firms are increasing their presence in Los Angeles.[6]Andrea Chang and Peter Jamison, “Playa Vista Turning into Silicon Valley South as Tech Firms Move In,” Los Angeles Times, January 17, 2015. These factors are creating the kind of community that should continue to attract talent and capital. According to AngelList data, only Silicon Valley and New York have more start-up activity than Los Angeles.

Source: “AngelList Locations,” AngelList LLC, accessed August 6, 2015, angel.co/locations.

Notes: Boston, Los Angeles, and Silicon Valley include Cambridge, Santa Monica, and San Francisco, respectively.

Relative price levels provide an additional incentive for launching a business in Los Angeles rather than the Bay Area or New York. Relative to Los Angeles, office space is 120% higher in New York and 94% higher in San Francisco, and the overall cost of living is 65% and 23% higher, respectively, in these two other major metropolitan areas.

Sources: Jones Lang LaSalle, IP, Inc., JLL Q1 2015 Office Statistics Report, 2015, PayScale Cost of Living Calculator, generated using comparative city data from C2ER, payscale.com/cost-of-living-calculator, August 21, 2015.

Notes: Office space figures include the central business district as well as suburban areas. Data for both variables were indexed to price levels in Los Angeles. Higher index levels imply higher prices. San Francisco Peninsula cost of living data are not available on the PayScale Cost of Living Calculator.

A key niche in LA’s tech ecosystem is digital media production. Hollywood is home to many of the world’s content creators, and Los Angeles is the de facto headquarters of the digital media industry. Successful recent exits in this space include an online content platform, a studio specializing in short-form media, and a virtual reality company. Video game development is another important feature of LA’s tech community, and companies based in Los Angeles include both established firms and newer ventures. Notably, several managers have expressed a preference to avoid investments in digital media content like video games given the space’s sensitivity to nebulous consumer tastes. Nonetheless, digital media and content creation form an important part of LA’s tech ecosystem.

The Missing Link: Venture Capital

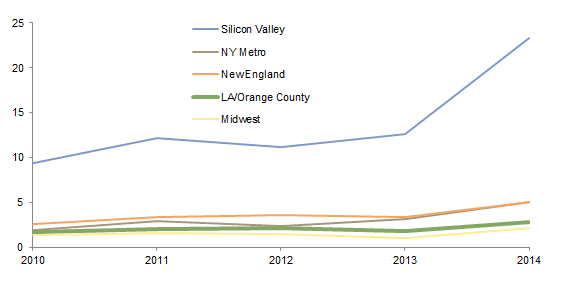

Los Angeles has a strong pool of technical and entrepreneurial talent, and a supportive community for incubating future talent through start-ups, as well as a specialized niche in digital media. Yet, relative to other regions in the United States, the amount of venture capital deployed in Los Angeles is low. The source of this market inefficiency is unclear, but two factors might explain some of the mismatch between the number of investment opportunities and actual capital availability.

First, the growth of a local VC ecosystem may have been stunted by the crowding out effect of Silicon Valley capital. Bay Area firms are very active in Los Angeles, particularly after the seed stage, and we believe these firms will remain an important part of the VC landscape in Los Angeles and other markets. Given the quality of these managers, local firms can find it difficult to compete. Some managers that used to be active in Southern California have either stopped operating or have completely restructured since the 2008 financial crisis, although several newer managers have spun out of these firms.

Second, the capital market cycle of the past decade put pressure on the supply of venture capital in Los Angeles. Several companies, particularly in the ad-tech space, generated early momentum following acquisitions by Google and Yahoo in the early 2000s. However, the start-up ecosystem in Los Angeles was sparse during the 2000s, and some of these companies ultimately relocated to Silicon Valley. Performance by local VC firms at that time was middling, and the overall pace of growth was modest. The global financial crisis delayed the ecosystem’s maturation further.

Sources: PricewaterhouseCoopers/National Venture Capital Association MoneyTree™ Report and Thomson Reuters

Notes: Classifications in this report include: LA/Orange County (Southern California (excluding San Diego), the Central Coast and San Joaquin Valley), Midwest (Illinois, Missouri, Indiana, Kentucky, Ohio, Michigan, and western Pennsylvania), New England (Maine, New Hampshire, Vermont, Massachusetts, Rhode Island, and parts of Connecticut [excluding Fairfield county]), NY Metro (metropolitan NY area, northern New Jersey, and Fairfield County, Connecticut), and Silicon Valley (Northern California, bay area and coastline).

Now, several elements have come together to finally make the region a destination for founders,[7]Anecdotally, one local venture capitalist mentioned that in the past year or two, high-quality founders have been moving to Los Angeles over San Francisco or New York because they want to be in Los … Continue reading including more recent success stories for LA-based tech companies, a concerted effort by local leaders to rebrand Los Angeles as a hub for start-ups, and a lower cost of living than the Bay Area. However, though the number of start-ups in Los Angeles has increased, capital availability in the region does not yet appear to have been impacted, but some symbiotic relationships are beginning.

The Potential for Symbiosis: Venture Firms Outside Los Angeles. The more established, Silicon Valley–based venture firms appear to be developing a symbiotic relationship with seed and early-stage managers in markets like Los Angeles. Although this phenomenon is difficult to quantify, it stands to reason that as the venture market in Los Angeles develops, Silicon Valley firms would benefit by establishing relationships with local institutional managers that can serve as a deal pipeline for follow-on rounds of financing. This dynamic is in local founders’ best interest as well, as they will in many cases look to Bay Area firms to supply later stage capital. We have seen several investments that fit this model of symbiosis between local firms and Silicon Valley firms, and whether they continue will test how robust the model is. If local managers are able to continue to source and develop high-quality companies at their earliest stages, the managers would be well positioned to find follow-on capital in Silicon Valley, which will help generate attractive returns for investors.

Providing Resources in this Environment

We have long suggested limited partners emphasize the following manager characteristics in their VC portfolios:

- Top managers with established track records,

- Managers focused on making early-stage investments, and

- Promising managers early in their lifecycles.

In addition, factors like network and technical expertise remain critical in determining a manager’s ability to generate returns.

Are these characteristics present in Los Angeles? Silicon Valley offers the highest concentration of managers with established track records, but Los Angeles does offer access to managers that fall into the second and third buckets. Investors that see the promise of LA’s tech ecosystem and the potential to supply needed capital must be comfortable underwriting managers with a shorter track record that are investing at the higher risk end of the VC spectrum.

Although the early-stage manager landscape in Los Angeles is relatively thin, several new firms have emerged over the last few years, particularly to invest at the seed stage. Among these firms are new or re-started versions of those that ceased operations over the past several years.

For the most part, these managers are not behind the big headline exits of the past few years. An analysis of deals associated with 16 companies based in Los Angeles showed that the biggest winners were Silicon Valley venture firms. Of the investors with exposure to two or more of these deals, nine were located in Silicon Valley while only two were based in Los Angeles. Of course, limited partners should underwrite their investments with an eye toward future returns, not past performance. Nonetheless, we believe that high-caliber firms based in Northern California will continue to be well represented among the best deals. As a result, and given the symbiotic relationship beginning to blossom between venture firms in Northern and Southern California, a key variable to consider when evaluating seed and early-stage managers in markets like Los Angeles is the breadth and quality of their roster of co-investors.

The Bottom Line

Los Angeles has a vibrant tech ecosystem that is well positioned for future growth. However, the region is undercapitalized relative to other tech centers in the United States, and high-quality managers in Southern and Northern California are positioned to take advantage of this supply/demand mismatch. For high-quality managers based in Los Angeles, the risk-reward profile appears particularly attractive. An investment in this space may be appropriate for certain investors, particularly those with a dedicated opportunistic VC portfolio, or investors with smaller portfolios seeking exposure to emerging managers that may be willing to accept a smaller allocation than a more established Bay Area firm.

Nicholas Burns, Associate Investment Director

Theresa Hajer, Managing Director

Other contributors to this research brief include Erika Spence.

Footnotes