Where Do We Start?

An institution considering initiating or adding to a mission-aligned investing strategy must first define its objectives. Next, it should evaluate the available approaches and tools on portfolio structure, impact, and performance expectations. Any planned changes must be balanced with the need to continue support for ongoing operations and grantmaking activities.

Drawing on research that Cambridge Associates has conducted with major grant-making foundations, this paper discusses the shifting mission-aligned investment landscape and the importance of governance in developing and overseeing a mission-aligned investment program. We lay out important steps in the mission-alignment process to define the scope of the commitment, structure, key milestones, and measures of success. These insights are based on collective lessons learned from organizations with a range of experiences and missions.

The Shifting Landscape

Traditionally a foundation’s endowment portfolio has had a simple—not easy—objective of maximizing risk-appropriate returns to support the mission via grantmaking. The formula was straightforward: seek a competitive investment return to fund grants and programs that focus on societal and environmental impacts. Growing the investment portfolio will increase grantmaking capacity, which in turn helps to support the foundation’s mission. The traditional investment policy typically reflected this goal and laid out a growth-oriented mandate for the investment team to manage risk and to generate a consistent, and hopefully growing, spending stream.

Over recent years a growing awareness of environmental, social, and governance (ESG) issues has added layers to the investment process. Some foundations and their stakeholders have reconsidered the relationship between assets, investment strategies, and the achievement of the mission. For some, this introspection has compelled them to implement new ways to deploy assets in program-related investment (PRI) plans and/or to incorporate mission-related investment strategies in their endowments.

What is Mission-Aligned Investing?

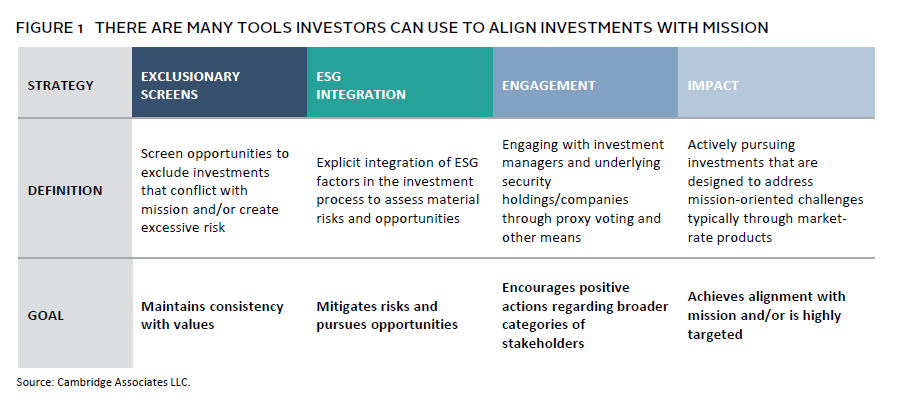

Mission alignment is a blanket term that describes incorporating objectives from an institution’s mission into investment decision making. There are many tools investors can use to align investments with mission. The field of sustainable and impact investing has evolved over the years from values-based exclusions to holistic incorporation of financially material risks and opportunities, often associated ESG factors (Figure 1).

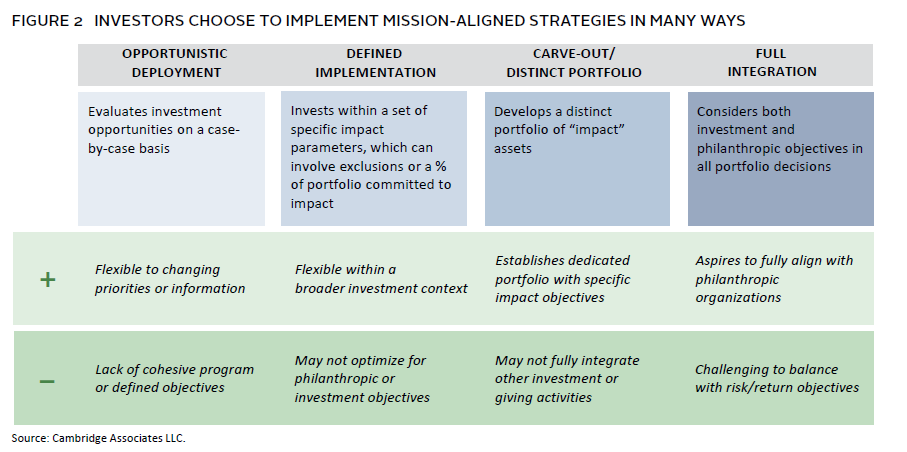

There are also degrees of adoption when it comes to implementation. Alignment can be integrated across the entire endowment, as a “carve-out” within the endowment, or as a carve-out outside the endowment (Figure 2).

Given all these tools and choices, there is wide disparity in how individual foundations define and implement mission alignment. The important work of governance is plotting a path that reflects the foundation’s priorities.

The Role of Governance

Throughout our conversations with major foundations that have initiated a mission-aligned investment program, we heard repeatedly about the importance of governance in planning, implementation, and oversight. We summarize the lessons learned and the steps followed in the development and articulation of a mission-aligned strategy.

Step 1 IDENTIFY component(s) of the mission that will be incorporated in investment strategy and provide clarity on what it means to be aligned

The details of interpretation and implementation and even the initial exploration of a mission-aligned investment program may reside with the investment committee or another sub-committee of the board. However, we have learned that the initiative will be more robust when there is ample opportunity for the full board to engage in the deliberations and actively participate in the ultimate decision. The implications of these decisions will affect the entire organization: investments, programs, and stakeholders. It is important to clearly define priorities, because the proposed alignment may reflect either a temporary or permanent shift away from the prioritization of preservation and growth of endowment purchasing power to support grantmaking, or at least a short-term disruption to the funds available for philanthropy. While disruption is a possibility, an institution can align with its mission in such a way that still maintains purchasing power to support grantmaking in perpetuity.

It also is possible that the deliberations will result in a rejection of pursuing a mission-aligned investment strategy. Alternatively, a foundation may choose to commit to a separation between the investment portfolio and the mission-aligned initiative.

Step 2 EVALUATE where you are

Once a foundation has identified the alignment priorities, it needs to develop a keen understanding of what is owned in the investment portfolio: that is, how alignment is defined (for example, exposure to certain products, ownership of specific companies, and/or industry specific definitions), where the portfolio is already aligned, and where investments undermine the goal. Given the dynamic nature of asset management and the fact that most investors delegate security selection to external managers and that some managers may be reluctant to share information on holdings, it is difficult, if not impossible, to know what the portfolio’s holdings are at every moment in time. However, an annual review can provide visibility into the degree to which the portfolio reflects an institution’s mission-alignment goals. This assessment identifies the changes that would need to be made to bring the entire endowment into alignment, how long it would take to make these changes, and the level of disruption that would result from implementation and therefore the resulting disruption to payout. This requires a review of both active and passive investment managers. While one can speculate about the tradeoffs that may exist in both risk and return in a mission-aligned portfolio by examining historical returns, it is difficult to predict the future. As with all investment decisions, careful oversight and evaluation is necessary.

Step 3 SELECT investment strategy that the foundation wants to pursue to achieve alignment goals and determine financial commitments required to meet those goals

The analysis conducted in Step 2 can help the foundation determine the best strategy for pursuing the four major implementation methods: exclusions, ESG integration, impact investments, and engagement in the entire portfolio. From there a working group would typically recommend the strategy or strategies that could be implemented to move the investment assets into alignment.

A multi-million-dollar question is “how much?” Should the foundation commit to aligning the entire endowment portfolio, a portion, or none? If the evaluation in Step 2 determines that total alignment would lead to a significant level of disruption to investment performance and programs, but the commitment to deploying investment assets to address mission is high, a compromise may result in a more modest initial recommendation to commit a portion (carve-out) of assets that are aligned with the goal. Over time, governance can reevaluate the impact on the portfolio’s risk/return profile and on funds available for grantmaking. The process may lead to additional commitments in the carveout or greater integration.

Step 4 DEVELOP the governance and professional resources to oversee the mission-related alignment initiatives

Our research shows that alignment efforts work best when governance and staffing follow a similar structure. For example, if the aligned portfolio is separate from the endowment portfolio, then the governance is the responsibility of a separate investment committee. If the alignment is conducted within the endowment portfolio, then the oversight is owned by the investment committee and the policy is reflected in the organization’s investment policy statement.

Step 3 determines the scope of the alignment effort and its structure: placement in the endowment or in a separate portfolio. Then a foundation needs to answer some key governance questions:

- Who will oversee the aligned portfolio?

- Should the oversight exist within the investment committee or in a separate group, and, if the latter, should there be overlap between the two investment committees?

- What perspectives, skills, and experience are needed to inform and oversee the effort?

Please see Tracy Abedon Filosa, “Endowment Governance Part 1: The Job Description,” Cambridge Associates LLC, May 2020.

The two most important jobs of the governing group are 1) approving the investment policy, including benchmarks and incentives, and 2) hiring the management team to implement the mission-aligned program (either within or separate from the existing investment team) and clearly defining roles and responsibilities.

The staff and professional resources dedicated to the effort should reflect the level of commitment to the effort. A modest effort to engage with managers or incorporate ESG into the manager selection process in the portfolio may be implemented by existing staff. A new mission-aligned investment mandate within or outside of the portfolio will most likely involve hiring additional staff with the expertise and network to implement the strategy. In either case it will be important to enlist the current investment leadership team to identify staffing and resource needs.

Step 5 UPDATE policies and incentives to reflect alignment goal and mandate

Our lessons learned again point to the benefits of aligning strategy, governance, management, and policies that guide the program. The governing body and staff and advisors who are working on the aligned portfolio should determine the financial and impact metrics that will measure progress and the timeframe over which progress will be evaluated. An Investment Management Agreement or compensation plan for internal staff should align incentives with the metrics and goals.

Next Steps

For a foundation that is considering initiating and/or increasing its commitment to mission-aligned investing, a thoughtful process is essential to reaching goals and achieving long-term success. Determining the right approach for the foundation’s mission and the endowment starts with reflection and education to build a shared understanding. This is a team sport that will involve trustees, senior leaders, and foundation stakeholders. No one person or committee can shoulder this commitment alone. Together they will ask and answer:

- What elements of mission should be incorporated into the endowment?

- How much of the portfolio will the institution allocate to mission? What tools will be used?

- What is the timeline for integration? What are the key milestones?

- What are the key measures of success? When will the institution reassess the strategy?

Mission alignment will not happen overnight, and a foundation must balance any planned changes with the need to continue support for ongoing operations and grantmaking activities. It is important to lay out a patient, but disciplined timeline for implementation. Plan to implement ideas and evaluate progress. Learning and adapting as you go are keys to success in mission alignment.

Tracy Abedon Filosa, Head of CA Institute

Katherine Cavanagh, Madeline Clark, and Sandra Urie also contributed to this publication.