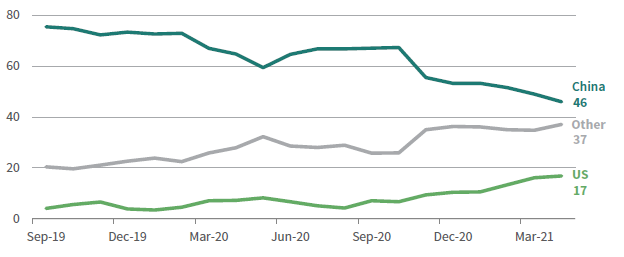

The polarizing and often misunderstood cryptoasset[1]Throughout this publication we use “cryptoassets” to serve as a catch-all term to describe cryptocurrencies, crypto tokens, crypto commodities, and all other blockchain applications. We use … Continue reading landscape has grown exponentially in recent years. These assets are still young, but they may grow in importance quickly. Indeed, it isn’t unreasonable to believe that cryptoassets are capable of redefining entire technological ecosystems. However, there are substantial risks associated with these assets, which has made them extremely volatile, and there will likely be many losers from an investment standpoint. This reality along with the sheer complexity and large environmental footprint of many of these assets understandably makes the space unattractive for many. But for those that see cryptoassets’ potential as more than offsetting their risks, we recommend they seek modest exposure through active, well-diversified funds managed by investors fluent in the complexity of these assets. This paper reviews some of the space’s pressing issues, considers cryptoassets in a portfolio setting, and offers some considerations of different implementation options.

Evolving Beyond Bitcoin

For more on how investing in blockchain technology differs from investing in bitcoin, please see Aaron Costello, “Cryptocurrencies: Boom or Bubble?,” Cambridge Associates LLC, October 2017.

Bitcoin was introduced just 12 years ago. The groundbreaking blockchain technology on which it was built has led to rapid growth in the crypto ecosystem, as thousands of cryptocurrencies, utility tokens, security tokens, and stablecoins have emerged in a short amount of time.

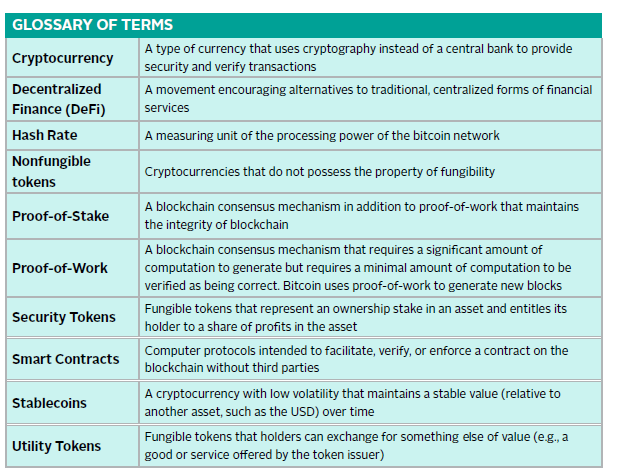

There are now more than 6,000 cryptoassets in circulation, representing a total market capitalization of more than $2 trillion as of September 2021 (Figure 1). Coinbase, the largest cryptocurrency trading platform in the United States, had an $85 billion initial public offering in April, as appetite for trading cryptocurrencies continued to climb. Bitcoin is still the most prominent cryptoasset by market value, but its share of the universe has ebbed in the past five years, and by mid-2021 it represented less than 50% of the total cryptocurrency market cap. Today, some of the largest cryptocurrencies rival the market caps of major publicly traded companies. As of August 31, 2021, bitcoin’s $800 billion market cap was larger than the float–adjusted market capitalizations of the Coca-Cola Company, Pfizer, Inc., and the Walt Disney company—combined.

FIGURE 1 THE COUNT AND VALUE OF CRYPTOASSETS HAVE INCREASED EXPONENTIALLY IN RECENT YEARS

2013–21 • Total Cryptoasset Market Cap (Logarithmic Scale)

Source: CoinMarketCap.com

Notes: Data for 2021 are as of September 6. Total count and market value are estimated based on data availability.

Such high valuations for nontangible digital currencies raise questions about whether some prices are in a bubble. But proponents advocate that blockchain technology is revolutionary and could be analogous to the early days of the internet. Bitcoin is just one application of the blockchain technology, aimed at digitizing money and banking. The technology is being applied in various fields to digitize other tangible things, securely execute business processes, and introduce authentication to internet communication and commerce. One area that continues to gain traction is decentralized finance (DeFi), which enables financial transactions without reliance on centralized intermediaries and offers numerous advantages over traditional finance.[2]For a detailed discussion of the rapidly growing DeFi landscape and its future opportunities, please see Harvey Campbell, et al., “DeFi and the Future of Finance,” SSRN, December 2020. Still, many of these projects are in early stages. Much like the early internet or early-stage venture, there will be a high failure rate. For many of these crypto tokens in this increasingly saturated market, the question is not “when,” but “if,” these technologies will ever work as intended. There are projects that are working as intended, but we have yet to see which ones will be the “winners” and generate mainstream adoption. For this reason, investors looking to enter the space are more likely to realize gains by focusing on diversified baskets of cryptoassets, rather than individual offerings.

Key Risks

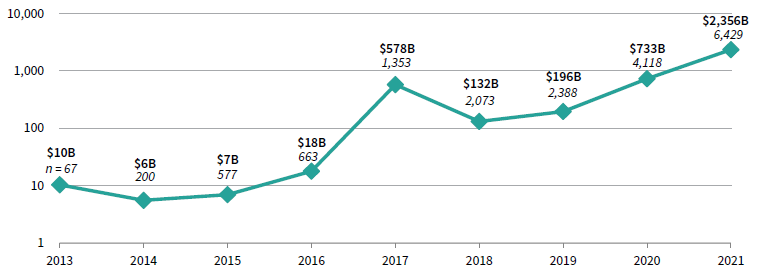

Volatility. Bitcoin’s original raison d’être was decentralized, secure monetary transactions. However, over time it has become clear that much of the interest in bitcoin is speculative as buyers simply chase price appreciation. This has led to rapid price swings. In the past ten years, bitcoin has experienced three distinct drawdowns of at least 70% (Figure 2). By comparison, US equities have only ever experienced one drawdown of that magnitude in the past 100 years, during the Great Depression. While bitcoin has rebounded to new highs from each of these declines, the ride has been anything but smooth. Lowering the drawdown threshold gives a clearer indication of how frequently bouts of volatility occur. Bitcoin has experienced 27 drawdowns of more than 20% in the past decade. US equities have experienced only 16 such drawdowns in the last century. A more apt comparison for bitcoin might be a higher beta sector, such as technology stocks. But tech stocks have only experienced two drawdowns of more than 20% in the past decade. While the cryptoasset landscape goes well beyond just bitcoin, similar (or even greater) magnitudes of volatility have been observed in other popular cryptoassets with sufficient observable history, like Ethereum and Litecoin.

FIGURE 2 BITCOIN HAS EXPERIENCED THREE DRAWDOWNS IN EXCESS OF 70%, BUT HAS CONSISTENTLY SHOWN RESILIENCE

September 30, 2011 – August 31, 2021 • Price of Bitcoin on Logarithmic Scale

Source: Thomson Reuters Datastream.

Note: Periods ended September 30 for each year shown, with the exception of 2021, which ended on August 31.

Environmental, Social, and Governance (ESG) Concerns. Institutional investors continue to face dilemmas over whether cryptoassets can align with ESG mandates. Among these standards, environmental concerns have garnered the most attention, and for good reason. Bitcoin mining is a highly energy-intensive process. According to the University of Cambridge’s Center for Alternative Finance, bitcoin consumed as much as 130 terawatt hours of energy (on an annualized basis) in May 2021. By some estimates, this is ten times higher than the annual energy consumption of internet giant Google, and higher than the entire annual energy draw of many countries—including Argentina, the Netherlands, and Sweden. The amount of energy that bitcoin consumes fluctuates over time; it is directly correlated to its price, as higher prices create more incentive to mine and the mining hash rate[3]“Hash rate” or “hashing power” is a common metric that measures the collective computing power of a cryptocurrency network. A higher network hash rate typically means that the network is more … Continue reading rises. A higher bitcoin price in the future could push the bitcoin network’s energy consumption much higher. When investors consider how the carbon footprint of cryptoassets will align with environmental values, there are several other key considerations. First, China’s recent crackdowns have drastically changed the landscape of miners, which could impact the percentage of bitcoin mining that is powered by renewable energy sources. Second, more cryptoassets are using less energy-intensive methods for verifying that blocks are valid on the blockchain.

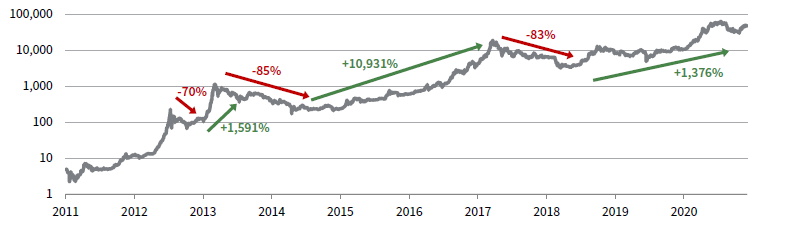

China has dominated the share of global power used to support the bitcoin network for years, but this dominance has waned as regulators in Beijing tightened their crackdown on bitcoin mining. Many miners were forced to shutter their operations in China and the country’s share of mining power declined from 76% in September 2019 to less than 50% in April 2021 (Figure 3). Many of the Chinese miners had relied on coal power and older, inefficient mining equipment for operations. As miners have been forced to relocate to different locales, bitcoin’s carbon footprint could be reduced, all things equal. Miners are incentivized to find affordable power, and renewables could soon become an even greater proportion of bitcoin’s energy draw.

FIGURE 3 SHARE OF GLOBAL HASHING POWER SHOWS CHINA’S DOMINANCE IS WANING

September 2019 – April 2021 • Percent (%)

Source: University of Cambridge – Cambridge Centre for Alternative Finance.

Energy consumption is directly tied to how cryptoassets are brought into circulation. On the blockchain, “consensus mechanisms” are used to validate the legitimacy of transactions and to create new coins. Bitcoin and other popular cryptocurrencies use a proof-of-work mechanism, where miners compete to solve complex mathematical problems. This process requires large amounts of computing power and results in high energy usage. But there are more energy-efficient alternatives to proof-of-work that are gaining adoption among other cryptoassets. Most notable is the proof-of-stake mechanism, where network participants are incentivized to validate transactions rather than mining. To “stake,” participants are essentially required to make a security deposit of their cryptocurrency to get the chance to verify transactions on the block. Ethereum, the second largest cryptoasset in existence, is in the process of switching to this mechanism and has estimated such a change would reduce its energy consumption by 99%. Proof-of-stake is just one example among several alternative consensus mechanisms that blockchain networks are embracing. Thus, investors should be cautious not to assume that bitcoin’s energy consumption concerns apply to all cryptoassets. It is also misleading to extrapolate out the current electricity consumption of bitcoin, since bitcoin could move to less energy-intensive proof-of-work models and renewables are increasingly favored for the miners moving out of China.

Social and governance components are often overlooked in the ESG discussion. These can be more difficult to quantify. If cryptoassets are destined to offer DeFi solutions, promoting widespread inclusion, then the social component would be a positive. Still, illicit activity is a glaring social concern, as the anonymity of transactions can enable money laundering, although anonymity isn’t as great as is popularly believed since transactions are permanently included in the blockchain ledger for anyone to see. In the same vein, the lack of governance for decentralized cryptoassets means there are few protections for owners of the digital currencies. However, this narrative is shifting as regulators provide more guidance for the owners of these assets. Illegal transactions are estimated to be declining as regulation has increased. Overall, investors should be mindful that the social and governance components have both pros and cons for investors.

Government Regulation. The potential for tighter regulation has loomed large over the cryptoasset space as guidelines continue to evolve. New US Securities and Exchange Commission (SEC) Chairman Gary Gensler, who has a deep understanding of cryptoassets, has called for stronger investor protections in the space. Such measures could be beneficial by engendering more trust in digital currencies, which in turn could reduce price volatility. With a reduction in volatility, it stands to reason that some of the return premium in these cryptoassets could also be diminished.

Cryptoasset prices have been sensitive to regulatory changes, especially to recent developments in China. In late September, the People’s Bank of China declared all cryptocurrency transactions and mining illegal. The ban applies to all transactions—including business dealings—that involve cryptoassets. China’s tightening crypto regulation has likely influenced price volatility throughout 2021. At the same time, China has continued testing the concept of a sovereign digital currency across various regions. If other governments issue bans like the recent ban in China, crypto prices would likely be negatively impacted. But regulatory measures could evolve differently across major markets, and investors should not assume that tighter regulation will necessarily be bad for cryptoasset prices in the long run.

Security. Another ongoing challenge is the safety and security of cryptoassets. While it is exceptionally difficult for bad actors to infiltrate blockchains, hackers have taken advantage of crypto exchanges and individual holders who do not follow necessary protocols to store cryptoassets. In addition, encryption failures and flaws in code can present vulnerabilities for digital assets.

Some also question whether technological advancements, such as quantum computing, could make holders of cryptoassets more vulnerable. Digital encryption relies on the computational difficulty of complex mathematical problems that can be much simpler to solve using a quantum computer. Indeed, breakthroughs in supercomputing could threaten cryptographic security measures, but blockchain security could also evolve with these advances.

Role in Portfolio

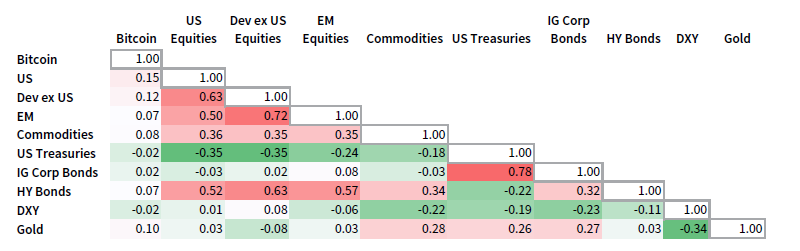

Cryptoassets are high-risk investments that have exhibited a low correlation to traditional asset classes. Since 2014, bitcoin was uncorrelated with nearly all major assets (Figure 4). Historical performance suggests that these assets could act as diversifiers in normal market environments, but they should not be expected to perform like safe havens during periods of market stress. One example is the COVID-19 pandemic-related sell-off during early 2020. US equities suffered a 34% drawdown in a one-month span, but bitcoin lost 39% in one day during that period. The availability of high leverage has surely played a role in bitcoin’s big price movements; certain exchanges had offered 100-to-1 leverage up until mid-2021. Volatility is also linked to the fact that cryptoassets are difficult to value. Prices are generally tied to investor sentiment, user demand, scarcity, and coin or token utility, but the lack of cash flows make it difficult to value these investments, or to feel confident relying on them for downside protection.

FIGURE 4 BITCOIN HAS HAD A LOW CORRELATION WITH OTHER MAJOR ASSET CLASSES

January 1, 2015 – August 31, 2021 • Local Currency

Sources: Bloomberg Index Services Limited, Federal Reserve, MSCI Inc., and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: Equity returns are net of dividend taxes. “US” is represented by MSCI USA Index, “Dev ex US” is represented by MSCI World ex US Index, “EM” is represented by MSCI EM Index, “Commodities” is represented by Bloomberg Commodity Index, “US Treasuries” is represented by the Bloomberg US Treasury Index, “IG Corp Bonds” is represented by the Bloomberg US Corporate Bond Index, “HY Bonds” is represented by the Bloomberg US Corporate High Yield Index, and “DXY” represented by the US Dollar Index.

Small bitcoin allocations did improve the performance of a traditional portfolio of equities and bonds in a recent period we reviewed (Figure 5). And, diversified crypto allocations offered an even more attractive risk/return profile during the same period. Nevertheless, the limited history of less than five years is representative of a time frame during which there was high speculation, excess market liquidity, and minimal regulation in the cryptoasset space, which could clearly give a false indication of return potential going forward. Additionally, poorly timed investments in cryptoassets could have detracted from overall portfolio returns. This is true for investors that bought into bitcoin in late 2017, when prices were surging, then hastily closed positions after massive drawdowns in the next two years.

FIGURE 5 INCORPORATING BITCOIN INTO A TRADITIONAL PORTFOLIO MEANT HIGHER RETURNS, HIGHER RISK. . .

December 31, 2016 – June 30, 2021 • Percent (%)

Sources: Bitwise Asset Management, Bloomberg Index Services Limited, and Thomson Reuters Datastream.

Notes: Traditional portfolio represents 60% MSCI All Country World Index and 40% Bloomberg Aggregate Bond Index. The Bitwise 100 Total Market Crypto Index (BITW100) tracks the total return of the 100 largest cryptoassets, as measured and weighted by free-float market capitalization. +1.0%, +2.5%, and +5.0% bitcoin allocations reduce the equity and bond allocations equally. For instance, the +5% bitcoin portfolio consists of 57.5% equity, 37.5% bonds, and 5% bitcoin. Calculations use monthly rebalancing.

Implementation Considerations

For many investors, the risk and complexity of cryptoassets are too great to allocate to now. But for those investors that see the space’s potential as more than offsetting its risks, they must consider how best to gain exposure. To some extent, the cryptoasset space has similarities to commodity, currency, hedge funds, and early-stage venture capital investments, allowing investors to borrow techniques from each. Currently, we see five main approaches to gain exposure: 1) direct cryptoasset holding, 2) passive funds, 3) hedge funds, 4) venture capital, and 5) fund-of-funds.

- Direct Cryptoasset Holding. Investors may choose to hold individual cryptoassets independently or through a trusted third-party custodian. Pure investments could be appropriate for investors that understand the elevated risks but want the most simple, liquid offering in the cryptoasset space, with the lowest fees. However, there are several operational disadvantages for investors that choose to go this route. Securely storing individual cryptocurrencies can be complicated for new investors. Moreover, investors that use custodians (or exchanges) for cryptoasset holdings risk losing those assets if the exchange is hacked or the hacker gains access to the account.

- Passive Funds. Passive products exist today, and many more are in development. Passive products offer investors a straightforward option to get single-token or diversified exposure to different cryptoassets. Bitcoin exchange-traded funds (ETFs) or ETF-like products are available to many investors outside the United States. For US-based investors, the SEC is likely to approve a bitcoin futures-based ETF in the near future, based on comments from SEC officials. However, timing of an SEC approval of an ETF that holds bitcoin directly is unclear. Diversified, passive funds offer investors exposure to a range of digital assets. The key drawback of holding cryptoassets through passive vehicles is that they are costlier than holding the assets directly, although the fund is responsible for security.

- Hedge Funds may pursue a range of different strategies from long only to momentum to arbitrage, and many invest in seed stage and illiquid tokens. These funds are typically the most liquid of the active fund approaches, presenting opportunities for investors to take profits, but liquidity terms are generally more restrictive than in non-crypto hedge funds. While some hedge fund structures will call capital, others accept all capital on day one, when cryptoasset prices could be elevated. Funds may crystallize incentive fees annually, while some funds crystallize incentive fees at the end of the lock-up period. The best funds typically have premium fees, long notice periods, and extended redemption periods to fully exit.

- Venture Capital strategies have heavy exposure to seed and early-stage tokens and will own equity in companies, potentially providing more diversified exposure to the space. Funds choose when to call capital, allowing them to potentially take advantage of price dislocations. The long lock-up periods can also remove behavioral risks because investors can’t redeem during a crypto downturn. Still, there are several cons to venture funds in the crypto space. These funds will hold liquid tokens like bitcoin and ether, creating more volatile return streams than what investors are used to with private investments. Investments in seed tokens often have short lifecycles to success, but funds typically have much longer lifespans. Funds can distribute tokens instead of cash, but often give investors a choice. Like hedge funds, the best funds charge premium fees. Investors also must be aware of recycling provisions, which vary among venture funds.

- Fund-of-Funds are the simplest way to gain diversified exposure among the active approaches. Most have a mix of hedge funds and venture capital in their lineup, with global exposure. The best funds have established manager lineups so that investors can see which funds they will get exposure to; in some cases, underlying funds are difficult or impossible to access directly. Still, fund-of-funds are the most expensive way to gain exposure to the space. Liquidity is typically based off the worst liquidity of the underlying funds, even though many of the underlying funds offer better liquidity. As such, fund-of-funds investors face the same drawbacks as venture capital strategies with regard to rebalancing opportunities. Investors should review fund documents to see if there is the potential that they could receive tokens as a distribution.

Conclusion

The cryptoasset industry is complex, speculative, and unpredictable. And yet, we must recognize that blockchain technology offers the potential for groundbreaking technological advances. The risk/return profile of these investments will sit at the far upper right of the capital markets line, and their volatility will simply make these assets unsuitable for many investors. There will undoubtedly be many losers in the space, underscoring our preference for a diversified approach to capitalize on any long-term winners. ESG concerns remain a major sticking point, especially with cryptocurrencies that use proof-of-work consensus algorithms, but it is encouraging to see that there could be improvements and alternative options in this space.

Overall, it is impossible to know if these technologies will represent paradigm shifts across major industries, and it could take several decades to feel the true impact of innovations. More widespread adoption could soon also be driven by generational shifts to younger investors and consumers who are more constructive of these investments and technologies. The application and adoption of the technology remains in its early days, but it is no longer a retail-only investment. With many questions about the return potential of traditional assets, cryptoassets offer an interesting but risky value proposition.

Sean Duffin, Investment Director, Capital Markets Research

Joe Marenda, Kristin Roesch, Kenneth Tom, and Wyatt Yasinski also contributed to this publication.

Index Disclosures

Bitwise 100 Total Market Crypto Index

The Bitwise 100 Total Market Crypto Index (BITW100) tracks the total return of the 100 largest cryptoassets, as measured and weighted by free–float market capitalization.

Bloomberg Commodity Index

Bloomberg Commodity Index is made up of 22 exchange-traded futures on physical commodities. The index currently represents 20 commodities, which are weighted to account for economic significance and market liquidity. Weighting restrictions on individual commodities and commodity groups promote diversification.

Bloomberg US Aggregate Bond Index

The Bloomberg US Aggregate Bond Index is market capitalization–weighted and includes Treasury securities, government agency bonds, mortgage-backed bonds, and corporate bonds. It excludes municipal bonds and Treasury inflation-protected securities because of tax treatment.

Bloomberg US Corporate Bond Index

The Bloomberg US Corporate Bond Index measures the investment-grade, fixed-rate, taxable corporate bond market. It includes USD-denominated securities publicly issued by US and non-US industrial, utility, and financial issuers.

Bloomberg US Corporate High Yield Index

The Bloomberg US Corporate High Yield Index measures the US corporate market of non-investment-grade, fixed-rate corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Bloomberg US Treasury Index

The Bloomberg US Treasury Index measures USD–denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint, but are part of a separate Short Treasury Index. STRIPS are excluded from the index because their inclusion would result in double-counting. The US Treasury Index was launched on January 1, 1973.

MSCI All Country World Index

The MSCI ACWI is a free float–adjusted, market capitalization–weighted index designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 23 developed and 26 emerging markets country indexes. The developed markets country indexes included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The emerging markets country indexes included are: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, the Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates.

MSCI Emerging Markets Index

The MSCI Emerging Markets Index represents a free float–adjusted market capitalization index that is designed to measure equity market performance of emerging markets. Emerging markets countries include: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, the Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and the United Arab Emirates.

MSCI US Index

The MSCI US Index is designed to measure the performance of the large- and mid-cap segments of the US market. With 617 constituents, the index covers approximately 85% of the free float–adjusted market capitalization in the United States.

MSCI World ex US Index

The MSCI World ex US Index captures large- and mid-cap representation across 22 of 23 developed markets countries—excluding the United States. With 934 constituents, the index covers approximately 85% of the free float–adjusted market capitalization in each country.

US Dollar Index (DXY)

The US Dollar Index is used to measure the value of the dollar against a basket of six world currencies—Euro, Swiss Franc, Japanese Yen, Canadian dollar, British pound, and Swedish Krona. This index is similar to other trade-weighted indexes, which also use the exchange rates from the same major currencies. The value of the index is fair indication of the dollar’s value in global markets.

Footnotes