Summary of Policy Benchmarking Approaches

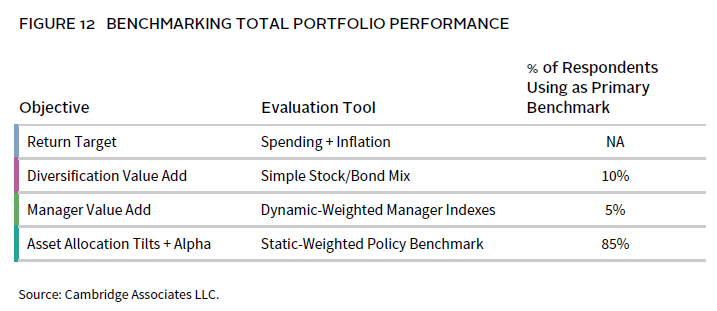

Benchmarking investment performance is an essential piece of an endowment’s well-functioning governance process. When selecting a benchmark, it is important for institutions to understand what they are trying to evaluate (Figure 12). There is no single benchmark that can assess every single aspect of portfolio management. Consequently, it is not uncommon for institutions to use multiple benchmarks in their performance evaluation process. In our survey, we asked respondents to provide both the real return objective for the endowment and the primary benchmark used to evaluate investment performance at the total portfolio level.

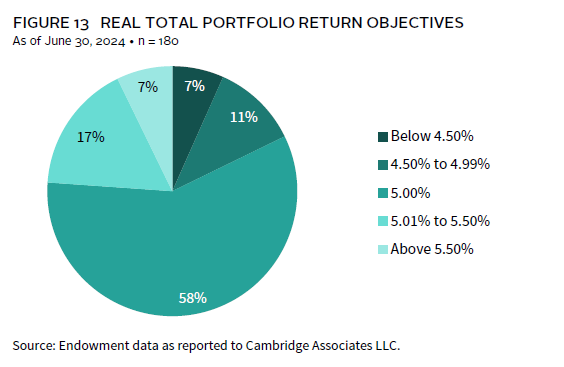

A fundamental part of an endowment’s investment policy is the return objective. Most endowments use a spending policy that is connected in some way to an annual spending rate. That percentage rate serves as the basis for establishing a minimum return target that endowments aim to earn over the long term. If an endowment can generate an investment return that exceeds the sum of its spending rate and inflation, it can maintain or grow the purchasing power of its assets over time. The most common real (i.e., inflation-adjusted) return objective among endowments continues to be 5% (Figure 13).

In the Investment Portfolio Returns section, we cited the performance of a blended index weighted 70% to the MSCI ACWI and 30% to the Bloomberg Aggregate Bond Index. For endowments that are diversified across alternative asset classes, this benchmark helps to evaluate whether the decision to diversify the portfolio added value. Our comparisons of median endowment performance versus the 70/30 benchmark show how the peer universe in general measured up to a simple, passive investment option.

In practice, just 10% of respondents reported that a simple blended index was the primary benchmark used for their total portfolio return. A majority of this subgroup used a blend weighted 70% to an equity component and 30% to a bond component. However, there were other endowments that used higher weightings for the equity index—85% was the highest reported—while there was one respondent that reported a weighting as low as 50%. The most appropriate weightings for this type of benchmark would be a blend that aligns with the targeted risk profile of the portfolio. In fact, about one-third of this subgroup also use only two categories in their target asset allocation policy, and the weightings of the equity and bond indexes matched their policy targets to the equity/growth and bond categories in their policy structure.

The remaining peers in the universe use a policy benchmark that had three or more components. The vast majority (85%) use a blend of indexes with static weightings that align exactly or closely with the asset classes and target percentages specified in their asset allocation policies. This type of benchmark helps an institution evaluate how its endowment performed relative to the blended index that represents its default or normative position. A handful of respondents (5%) use a blend of manager-specific indexes, where the weightings update frequently (e.g., monthly) to match each manager’s allocation within the portfolio. This type of benchmark is intended to focus on manager selection decisions and neutralizes the effects of over/underweights of the actual asset allocation versus policy targets. The figures that follow provide more detail on benchmarks for the endowments that use a dynamic-weighted or static-weighted policy benchmark.

Components of Policy Portfolio Benchmarks

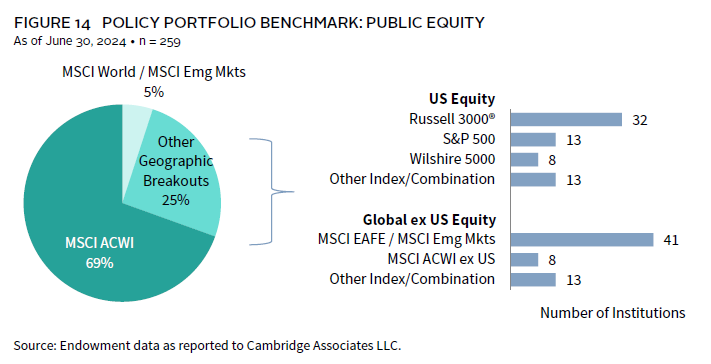

The MSCI ACWI continues to be the most common measure for benchmarking public equities. More than two-thirds of the respondent group use this index to represent their entire public equity allocation in the policy portfolio benchmark. The remaining respondents use a combination of indexes that are more geographically defined. For those that use a US-focused benchmark, the Russell 3000® Index was by far the most prevalent. For global ex US equities, a combination of the MSCI EAFE Index and the MSCI Emerging Markets Index was cited most often. The percentage breakdown among the peer group in Figure 14 looks almost identical to the survey responses from last year’s edition of this study.

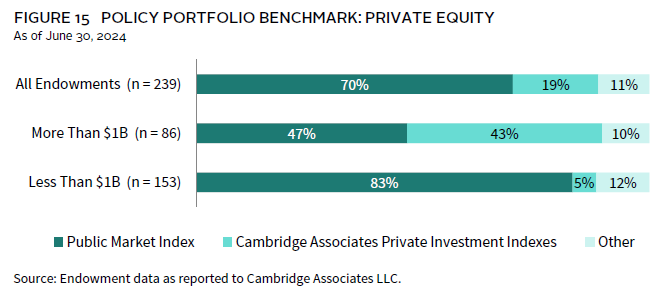

When evaluating PE/VC in the policy benchmark, most institutions select either a public index(es) or the CA private investment indexes (Figure 15). A majority of the overall universe (70%) uses a public index, with the MSCI ACWI being the most preferred index among this cohort. The rationale for using a public index is that the public equity bucket in the portfolio was the funding source for private equity allocations. And if the portfolio did not invest in private equity, that capital would have remained with the public equity allocation. The use of a public index primarily evaluates whether the decision to invest in private markets paid off for the portfolio.

There are some shortcomings to using a public index to benchmark private equities. Most notably, the public stock market is not a universe of securities that is representative of private equity investments. Consequently, in years such as 2024, where there are large differentials between public equity and private equity performance, the spread between the portfolio return and the benchmark return can be more reflective of those market dynamics than of how well the management team implemented the private portion of the portfolio. Approximately 19% of respondents instead use the CA private investment indexes to represent private equity in the policy benchmark. These indexes do not meet the ideal properties of benchmark as they are not transparent or investable. However, they are a universe of institutional-quality private investment funds that are more representative of the asset class compared to a public index.

The remaining 11% of respondents use some other method to account for private investments in the policy benchmark. A little more than half of the endowments in this other category use the actual private investment return, which essentially neutralizes the impact of these assets in the benchmark evaluation. This approach is used by endowments that have newer private investment programs and wish to delay the inclusion of these assets until performance comparisons are more meaningful. Also included in this other category are endowments that use a public index return plus a prespecified percentage. While this practice was once the most common benchmarking approach for private equity among peers, its use began to diminish quickly in the mid-2010s and only a handful of endowments continue to include this in present-day benchmarks.

There was a noticeable difference in the breakdown of responses by asset size. For endowments less than $1 billion, a public index was by far the most common practice. In contrast, approaches were more mixed among endowments more than $1 billion, with the CA private investment indexes being cited by more than 40% of respondents. The private investment indexes can be custom weighted by vintage year and exposure across different strategies, which helps to evaluate fund selection. It is likely for this reason that the approach continues to be prevalent among larger endowments, of which many have performance-based incentive compensation programs for their investment staff.

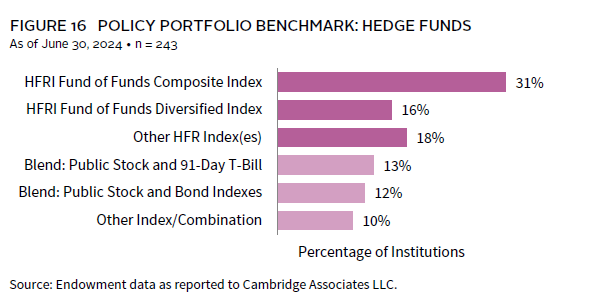

Endowments also face similar challenges of selecting an appropriate index when accounting for hedge fund allocations in the policy benchmark. Most respondents continue to use one or more indexes produced by Hedge Fund Research® (HFR), which tracks hedge fund managers that report to their database (Figure 16). Other approaches include a beta-adjusted benchmark, although the exact method varies across a few different options. When it comes to bonds, real assets, and other strategies, benchmark combinations are even more unique across the respondent group due to the variety of strategies and exposures under these categories.

Value Add Versus the Policy Benchmark

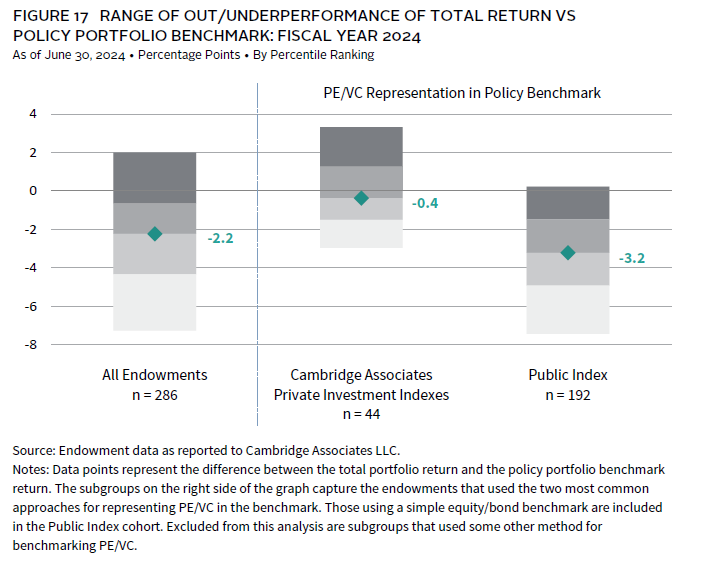

Most endowments fell short of their policy portfolio benchmark in 2024. Just 16% of respondents reported that their total portfolio return beat their benchmark for the one-year period. When considering the spread between the portfolio return and the benchmark, the median across the respondent group was -220 bps for the fiscal year. Outcomes varied widely across endowments, ranging from 200 bps of outperformance at the top 5th percentile mark of the universe to underperformance of 730 bps at the bottom 5th percentile (Figure 17).

When breaking the peer universe down further, it is clear that the type of benchmark used for private equity was a big factor in how well an endowment performed versus its overall policy benchmark in 2024. For endowments that used the CA private investment indexes, the median value add was -40 bps. More than 40% (18 of 44) of the institutions in this cohort actually outperformed their policy benchmark over the past year. In contrast, the median value add for endowments using a public index was significantly lower at -320 bps. Less than 10% (15 of 192) of the endowments in this subgroup outperformed their policy benchmark in 2024.

The different experiences of these two subgroups tie back to the relationship between public equity and private equity returns in 2024. The one-year horizon IRR of the CA Private Equity and Venture Capital Index was significantly lower than the mPME version of the MSCI ACWI (4% versus 20%). Therefore, an endowment using the CA private equity indexes would calculate a lower benchmark return than it would if using a public index. The difference becomes even more magnified the higher an endowment’s allocation is to private investments. Most endowments in our universe have 20% or more of their portfolios invested in PE/VC, so the index choice is consequential in the policy benchmark calculation.

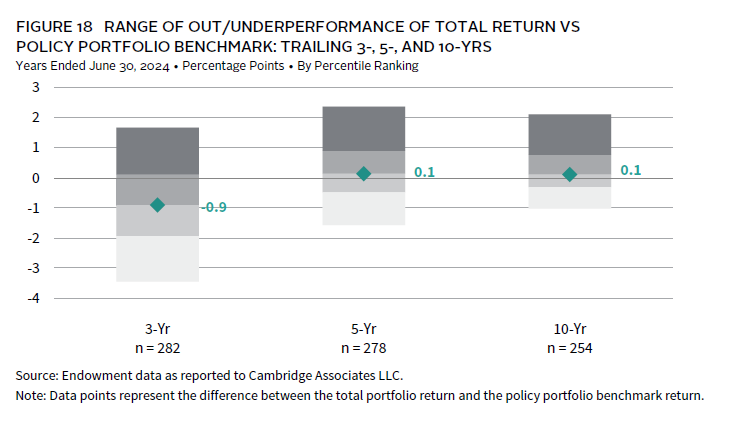

The different benchmarking approaches were less impactful on the value add statistics for the trailing three-year period (Figure 18). The distribution of value adds across peers was similar regardless of the benchmarking practice, and just slightly more than one-quarter of both subgroups outperformed their benchmark over this period. For the overall respondent group, the median spread between the portfolio return and the benchmark return was -90 bps. Endowments did fare better over the longer term, with most respondents outperforming their benchmarks over the trailing five-year and ten-year periods.