For yield-starved investors seeking reasonable returns with manageable risks (can we see a show of hands?), activist funds have been one of the major success stories of recent years, with high-profile managers such as Bill Ackman and Carl Icahn scoring a series of big wins and an increasing number of observers hopping on board the activist train. As a result, investors have poured money into the sector, and a self-proclaimed “new breed” of managers has burst onto the scene.

A few questions are thus worth asking. First, how different, if at all, is the new era of corporate activism from prior episodes? Second, is it reasonable to expect activists to be able to profitably invest the huge sums given to them in the past couple of years? And, finally, in the event an investor wants to allocate dedicated money to this sector, how should the investor go about analyzing and selecting a manager?

Our (admittedly not very satisfying) answers are: not very; probably not, although it is difficult to say; and very carefully. The recent surge in activism looks very similar to prior periods such as the “white sharks” of the 1950s, the “barbarians at the gate” corporate raiders of the 1980s, and even the so-called new breed of activists from the mid-2000s.[1]The subtitle from an April 2004 Economist piece on activists reads: “A new breed of funds is betting on its ability to improve corporate governance.” Today’s environment looks to be yet another cyclical surge, and interest will likely, as it has in prior periods, wax and wane according to returns, the economic cycle, investor and consumer moods, etc. All that said, a case can be made for including activist funds in portfolios so long as the investor picks the right one(s). Similar to private equity, we expect the best activists will provide long-term returns not only superior to the market, but strong enough to compensate for the long lock-ups and illiquidity inherent to the sector.

The Recurring Theme of Activism

Many recent write-ups of activist funds have treated the idea of corporate activism as a brash new strategy. Yet activism has arguably been around since the 1800s, and in its current form dates at least from the 1950s, when men such as Thomas Mellon Evans, Leopold Silberstein, and Louis Wolfson “waged corporate warfare with … brilliance and zest.”[2]Diana B. Henriques, The White Sharks of Wall Street: Thomas Mellon Evans and the Original Corporate Raiders (New York: Scribner, 2000). Activism fell out of favor during the bleak days of the 1970s, but roared back in the 1980s, only to falter again after the Drexel Burnham Lambert implosion. It staged a brief resurgence after the tech bust but has only well and truly re-emerged on the public scene over the past few years, with a number of charismatic and outspoken personalities not only taking high-profile stances, but also occasionally going head-to-head—sometimes in televised debates—over warring positions.

None of this is meant to discount the value added in recent years by the current crop of activists, but investors should understand that corporate activism is not a “new” development—it has been a style of investing since before many of today’s market participants were born.

Money Money Money …

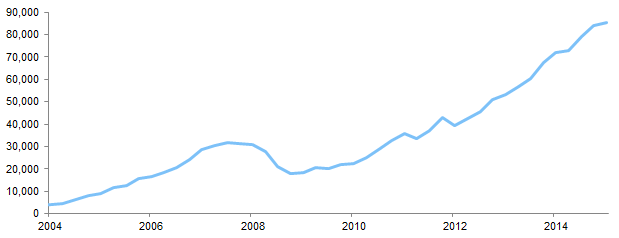

Activist funds have raised a lot of money in recent years, although exactly how much is difficult to say. Our internal figures for a representative sample of such funds show assets under management growing from $37 billion at the end of 2011 to $85 billion as of the end of June, although of course these numbers represent a variety of moving parts including inflows/outflows, returns, and in some cases the return of capital to investors. This growth is similar to that shown by commonly cited figures from Hedge Fund Research, Inc., which reports that such funds now manage more than $130 billion (as of the end of June), up from $51 billion at the end of 2011. None of these specific numbers should be taken as gospel; many funds engage in multiple strategies and not all of their assets should be considered “activist.” Regardless, the data suggest funds for activism have grown rapidly in just a few years.

Estimated Activist Fund Assets Under Management

Second Quarter 2004 – Second Quarter 2015 • US$ millions

Source: Investment manager data as provided to Cambridge Associates LLC.

Notes: Data represent six managers in second quarter 2004 and 11 managers in second quarter 2015. Managers have been identified as activist based on CA’s understanding of their strategy, but not all assets in the fund may be used for activism opportunities as many managers employ a multi-strategy approach.

Activism has clearly become more “socially acceptable” in recent years—although whether this is due more to activists taking a gentler approach[3]Perhaps best personified by ValueAct, which has become the poster child of using a quieter, less media-focused approach; i.e., working companies “behind the scenes,” perhaps most notably with … Continue reading or more to sometimes stellar returns, is an open question—which has clearly boosted investor interest in the sector. As with any investment strategy, the more money activism attracts, ceteris paribus, the lower returns will be. We would therefore, as a general rule, expect activist-type deals to become more competitive and subsequent returns a bit lower.

The First Shall Be … First?

How should investors interested in placing money with an activist go about it? Investors should be as discerning in choosing an activist fund as they are when placing money with other alternative strategies—it is not worth investing if you can’t identify the top performers. Activism tends to reward the same type of (self-reinforcing) skill sets as venture capital and private equity—e.g., industry contacts, patient long-term capital, and a history of similar, generally successful deals.

For more on the different types of activism, please see Marcos Veremis et al., “Introduction to Activist Investing,” Cambridge Associates Research Report, 2012.

We would also distinguish between “operational” activists—who seek to improve firms’ performance and thus boost their value—and those who employ financial engineering to drive returns, by, for example, leveraging companies’ balance sheets to make dividend payments to shareholders. While one is not necessarily better than the other (e.g., many view Carl Icahn’s demand that Apple pay out more of its cash hoard as solid corporate strategy), the former has historically proven more durable than the latter, in part because financial engineering strategies often rely on unstable variables such as low interest rates and pliable credit markets.[4]Although the length of the current easy money environment may have lulled some investors into complacency, it is important to remember that interest rates have not always been zero, and credit … Continue reading

Choosing an “activist fund” is not often straightforward—as already mentioned, most funds employ activism as one of many strategies. While it may seem like some funds are involved solely in activism due to the high-profile nature of their campaigns, this is not the case. Thus, investors in most “activist” funds should also be comfortable with the other fund strategies. In fact, many of the best funds tout their menu of strategies as a strategic benefit, as it allows them to “fish in the most attractive ponds” at any given time.

Many if not most of the funds starting now are simply following the trend of recent returns; activist funds with more experience have weathered good cycles and bad. As we have said before about hedge funds in general, manager selection in the activist space is critical. Top managers are likely to provide returns not only that are superior to the market, but also that compensate investors for locking up their money[5]Interestingly, while many activist funds have more restrictive terms than other hedge funds (e.g., longer lock-ups and more notification time to withdraw) they are significantly more liquid than … Continue reading; this is unlikely to be true (and historically has not been true) for the average manager.

Finally, any activist fund worth the name will be far from an index-hugger. These funds tend to be extremely concentrated, with their top ten holdings representing at least half the portfolio, and in a majority of cases over 75% of the portfolio. Returns and volatility for these managers vary widely from each other and from indexes. Given the likelihood of volatility greater than an index over short time periods, investors that make an allocation to these strategies should pay close attention to their own behavioral tendencies. In our experience, the drop in assets under management over 2008 and 2009 was due not just to portfolio losses, but also to investors fleeing the strategy after poor returns. Wide swings in returns from year to year in these strategies are to be expected. Investors therefore need a long-term horizon and strong stomach to consider making an allocation.

Sources: BofA Merrill Lynch, Barclays, Cambridge Associates LLC, Frank Russell Company, Hedge Fund Research, Inc., MSCI Inc., Standard & Poor’s, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: Calculations are based on monthly data, gross of fees. Managers have been identified as activist based on CA’s understanding of their strategy, but not all assets in the fund may be used for activism opportunities as many managers employ a multi-strategy approach. Crosshairs for standard deviation and return determined by placement of the MSCI World Index. Calculations are based on monthly data and manager returns are net of fees.

The Bottom Line

As with any investment strategy, activism is neither as bad as it seems during troughs, nor as good as it looks at peaks. Relative opportunities are likely to be negatively correlated with money flows and investor attitudes, and given the surge in interest in activists over the past few years, the environment seems nearer an activism top than a bottom. That said, the uneven distribution of returns in the sector is likely to persist, due mainly to the relatively few individuals and funds that possess the relevant skill sets necessary to succeed as an activist.

Given a choice today between competing investment strategies, activists would not be near the top of our list, as the fawning attention over successful activists—from media and investors alike—has narrowed the available opportunity set by boosting the available pool of money and drawing in new managers. However, while this is likely to make life more difficult for the best activists, it would not by itself convince us not to invest with them. As with successful private equity managers, top activists have proven their ability to thrive in a variety of market cycles.

Eric Winig, Managing Director

Emily Ginsberg, Investment Associate

Footnotes