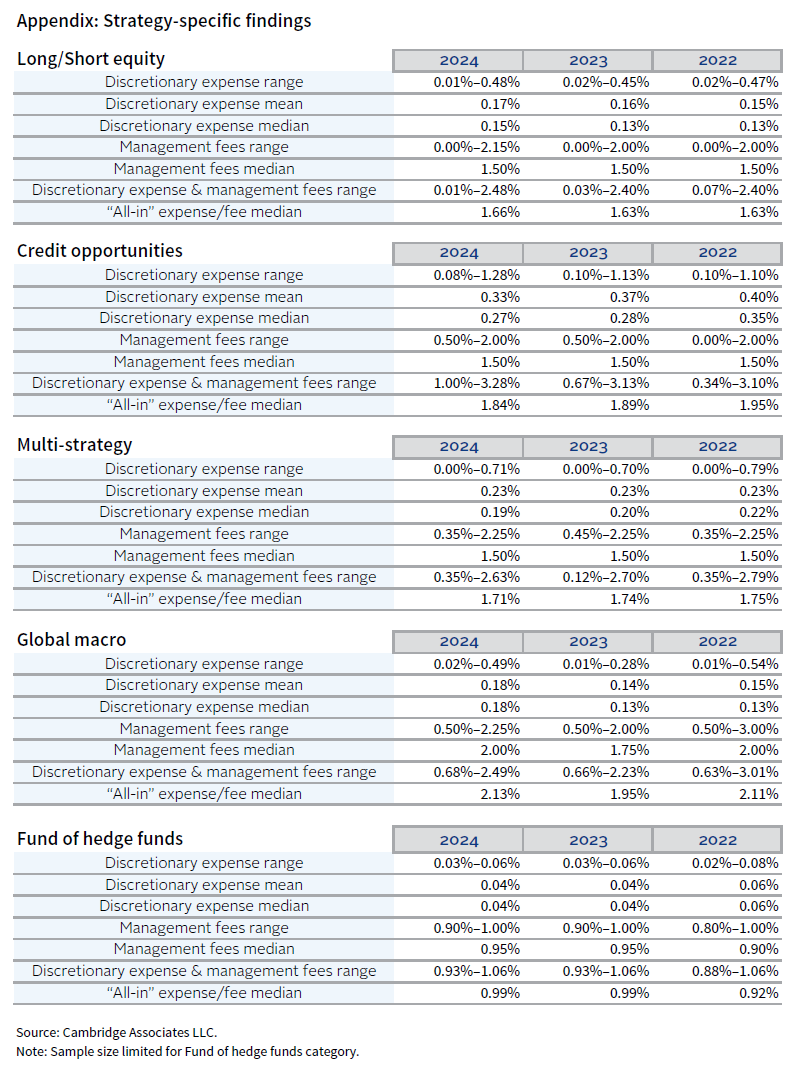

This report provides a comparative overview of management fees and discretionary expenses across five hedge fund strategies in Cambridge Associates’ manager universe—long/short equity, credit opportunities, multi-strategy, global macro, and fund of hedge funds—for the years 2022 through 2024. The data highlights the range, mean, and median of management fees, discretionary expenses, and “all-in” expense/fee medians for each strategy. Notably, global macro funds exhibited the highest all-in expense/fee medians, while fund of hedge funds reported the lowest. These insights can assist investors in understanding typical fee structures across different hedge fund strategies.

Discretionary expenses generally include administrative fees, professional fees, legal expenses, audit fees, directors’ fees, and other expenses, and exclude investment-related expenses such as dividend, research, and interest expenses. The discretionary expense ratios (DER) are based on the fund’s total discretionary expenses divided by the fund’s average net assets in the financial statements.

Key takeaways

- Across the hedge fund industry, DER have generally remained stable or experienced modest declines across most strategies, reflecting ongoing pressure from both investors and regulators.

- Credit opportunities funds continue to report the highest median DER among hedge fund strategies, while global macro funds exhibit the highest all-in expense/fee median. Fund of hedge funds strategies had the lowest DER; however, the relatively small sample size for this strategy limits the significance of these findings. These results are largely consistent with trends observed in prior years.

- Fee pressure from investors has prompted managers to occasionally outsource certain functions and pass these costs through to the fund, including expense items—such as back-office software—that were previously covered by the management company.

- The range of pass-through expenses remains broad, reflecting significant variation in fund expense policies regarding which costs are charged to the fund versus covered by the management company. In our view, appropriate expenses to pass on to the funds include audit, tax, legal, administrative, and directors’ fees—essentially, those items that provide a direct service to/for the fund. Although research costs are excluded from ratio calculations, these expenses are occasionally reported under “other expenses” in financial statements. Passing through extensive research or travel-related expenses can significantly increase expense ratios.

- The main drivers of expense variance among funds within each strategy are differences in fund expense policies—such as the inclusion of additional pass-through items like travel, technology, and salaries—and variations in fund assets. Most expenses, such as audit and administrative fees, tend to benefit from economies of scale. Accordingly, it is important to research and analyze expenses, considering both their historical economic impact and the fund’s expense policies.

Dataset

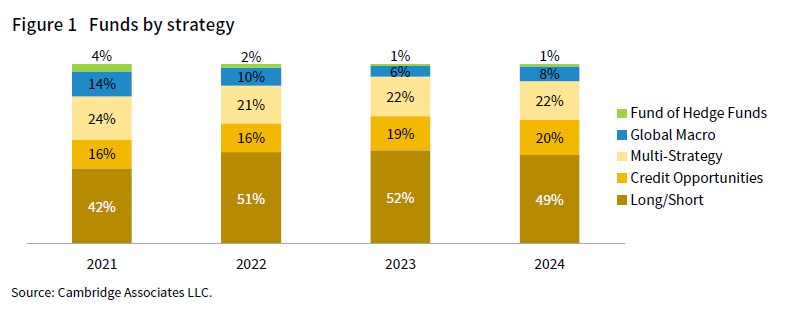

Figure 1 shows a breakdown of the funds analyzed over the past four years, categorized by strategy. The composition of strategies reviewed in 2024 is broadly consistent with 2023, with long/short, multi-strategy, and credit opportunities continuing to make up the majority of funds. The 2024 data set used includes audited financial statements from 159 funds managed by institutional-caliber alternative investment managers.

Summary of findings

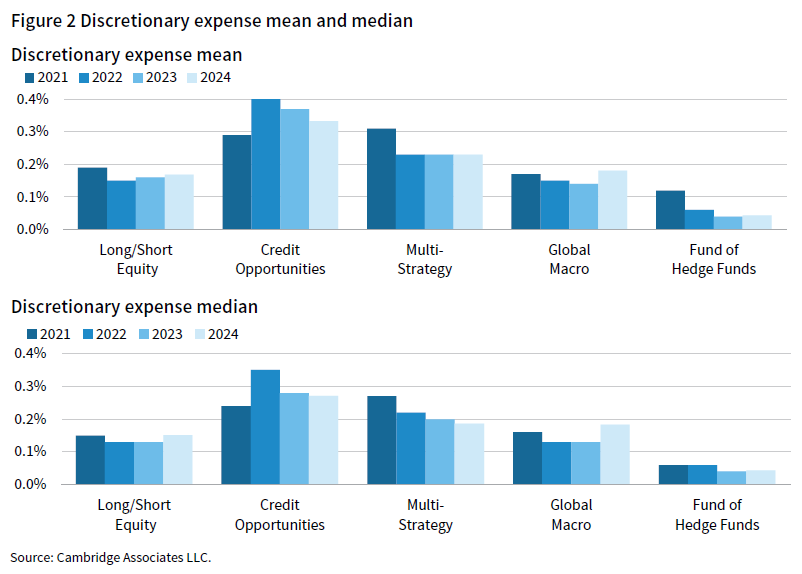

Overall, DER have generally remained stable or declined modestly in recent years, underscoring the industry’s ongoing focus on cost containment and transparency. Consistent with prior years, credit opportunities funds continue to report the highest mean and median DER among hedge fund strategies, reflecting the greater operational complexity inherent to their investment approach (Figure 2). Sourcing, structuring, and managing complex transactions also requires frequent engagement with legal counsel and external advisors, resulting in typically higher legal and professional fees compared to other strategies.

Conversely, fund of hedge funds exhibited the lowest DER, which could be due to their structure and investment approach. Instead of conducting direct research, trading, and portfolio management of individual securities, these funds allocate capital to a portfolio of underlying hedge funds. This model generally reduces the need for extensive research, trading activity, specialized expertise, and active management at the fund-of-funds level. The typically lower operational complexity of these strategies also contributes to reduced service provider fees.

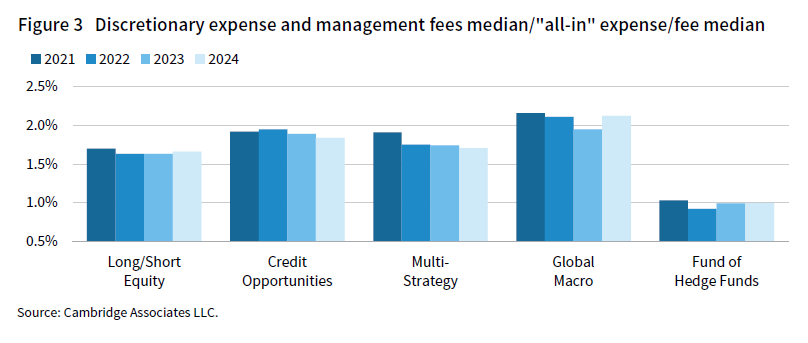

As illustrated in Figure 3, global macro funds continue to exhibit the highest “all-in” expense/fee median—a trend that has persisted over the past several years. In 2024, the three-year average discretionary expense mean and median for this strategy was 0.18%, closely aligned with long/short equity funds. However, the median management fee for global macro funds was notably higher at 2.00%, resulting in a three-year average “all-in” expense/fee median of 2.13%—the highest among all strategies analyzed.

Global macro funds typically engage in active trading across global markets, often employing sophisticated macroeconomic analysis, quantitative models, and a diverse range of financial instruments. These funds typically command higher management fees, reflecting the intensive trading activity and substantial level of active management required. Based on our analysis, these managers have consistently exhibited the highest median management fees[1]Management fees listed in this report are based on annual audited financial statements. Actual fees may vary depending on individual negotiations. compared to other hedge fund strategies in our dataset.

Full expense pass-through structures

In addition to traditional discretionary fees, certain multi-manager platforms employ a pass-through expenses model. Pass-through expense practices vary widely and range from business overhead costs to employee compensation. Below are highlights of notable managers that employ such pass-through practices.

- All reviewed multi-manager platforms employ the practice of passing through additional expenses to clients, beyond traditional discretionary fees. Managers in the sample oversee billions in assets under management, a scale that is required to compete for talent.

- Employee compensation consistently emerges as the primary component of these pass-through expenses across all managers reviewed. Compensation can include base salary, recruitment costs, and variable compensation for portfolio management teams. Variable compensation is generally charged in addition to a fund level incentive fee, exposing investors to possible netting risk.

- The specific structure and extent of pass-through expenses differ significantly between managers. Some managers may include a broader range of overhead costs, while others focus primarily on direct compensation.

- There is no uniform approach to how overhead and compensation-related charges are implemented. Each manager adopts their own methodology, leading to a wide range of expense practices within the industry. This diversity in approach reflects the absence of industry-wide standards for expense practices among multi-manager platforms.

Managers share the practice of passing through expenses—especially those related to compensation—but differ widely in how these expenses are structured and applied. This results in a broad spectrum of expense practices, with each manager tailoring their approach to their own operational model. Managers sampled pass-through fees range from 0.87%–12.99% with a mean of 5.93% and a median of 4.53%.

Footnotes