Major stock indexes, including in the United States, reached new highs last week, shrugging off the US federal government shutdown and ongoing labor market weakness. Global sovereign bond yields fell, and the US dollar softened following the shutdown.

- The US government shut down Wednesday after the Senate missed the September 30 funding deadline. “Non-essential” agencies halted operations and federal workers were furloughed. Shutdowns are typically brief, averaging eight days, and have minimal economic and market impact.

- The shutdown has already delayed some key data releases, starting with last Friday’s employment report. Other data last week, unaffected by the shutdown, showed further labor market softening—ADP private payrolls fell by 32,000 in September, and August figures were revised lower.

- Weaker jobs data increased bets for the Federal Reserve to cut rates by 50 basis points this year. The Supreme Court allowed Fed Governor Lisa Cook to remain in her role while a lawsuit challenging her firing proceeds, easing concerns about Fed independence.

- Business surveys suggest activity outside the labor market remains resilient. The S&P Global Composite PMI showed growth improved in the euro area in September, while US surveys signaled continued, albeit weaker, expansion. Flash euro area core inflation edged up to 2.35% in September.

- Healthcare stocks rallied, returning 6.9% week-to-date, after Pfizer and the Trump administration struck a deal to lower Medicaid drug prices in exchange for tariff relief, easing industry concerns that have weighed on stocks this year.

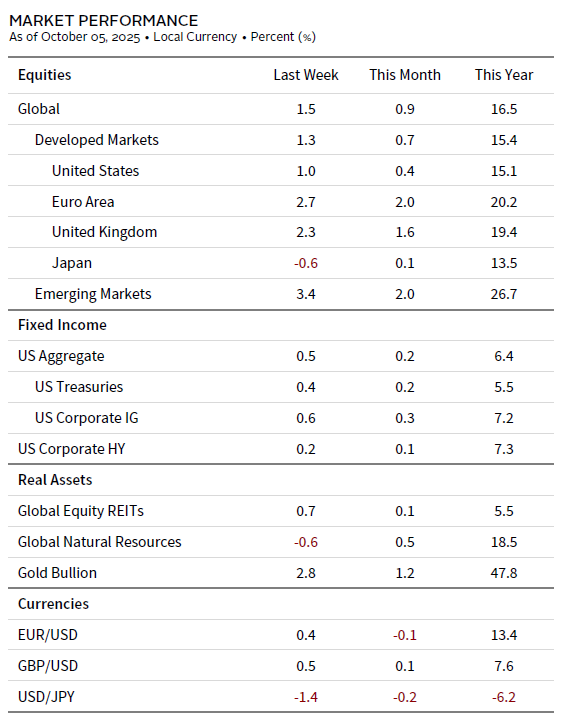

Sources: Bloomberg Index Services Limited, MSCI Inc., and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: This edition was prepared on October 5, 2025, and it reviews developments of the prior week. The equity data are total returns net of dividend taxes of MSCI indexes in local currency. Global natural resources equities are represented by the MSCI All Country World Commodity Producers Index. The fixed income data are total returns for Bloomberg indexes. Gold Bullion uses near-month gold futures contracts, as traded on the COMEX, to determine performance. Currency performance is based on Reuters data.