Third quarter 2019 proved to be the most challenging of the year for many hedge fund strategies, with the broad HFRI Fund Weighted Composite Index returning -0.4%. At the individual strategy level, the HFRI Macro (Total) Index gained 1.5%, the HFRI Event-Driven (Total) Index returned -0.6%, the HFRI Equity Hedge (Total) Index fell 1.1%, and the HFRI Credit Index returned 0.1%.

Geopolitical and growth concerns appeared to weigh on risk assets broadly. Heightened US-China trade tensions, the ongoing slowdown in Europe (particularly Germany and the United Kingdom, the latter due to Brexit), and a further inversion in the US Treasury yield curve combined to pressure both equities and credits. Risk aversion was particularly evident in August when the yield on the 30-year US Treasury bond touched an all-time low of 1.94% and the two-year versus ten-year curve inverted for the first time this cycle.

Major US equity indexes were mixed during the quarter. The S&P 500 Index returned 1.7%, marking its third consecutive quarterly gain, while the Russell 2000® declined 2.4%. International equities also retreated; the Stoxx Europe 600 Index and the MSCI Emerging Markets Index returned -1.8% and -4.2%, respectively, in USD terms.

The S&P 500’s positive return belied significant volatility intra-quarter. The tit-for-tat US-China trade war news, including frequent trade policy “tweets” by President Donald Trump, remained an important driver of the market’s short-term gyrations. In addition, September brought a severe equity factor rotation, a recurring theme in recent years. Momentum stocks, recently composed of both high-profile growth names, as well as less glamorous (but stable) “bond proxies,” sold off sharply, while value stocks enjoyed a brief resurgence. Yet, for the quarter, the Russell 3000® Value Index (1.2%) just barely outpaced the Russell 3000® Growth Index (1.1%). Meanwhile, widely held mega-cap growth stocks such as Amazon, Facebook, and Netflix traded down, and high-flying software-as-a-service (SaaS) and biotech names suffered significant losses.

Given the equity market’s violent rotation from momentum to value in late August and early September, losses for many technology- and healthcare-focused equity long/short (ELS) managers greatly exceeded the decline of the HFRI Equity Hedge (Total) Index. Notably, Morgan Stanley reported “September was the worst month for total alpha among ELS funds since 2010.”[1]Please see “September 2019 Hedge Fund Recap,” Morgan Stanley, October 3, 2019. Last quarter’s sharp factor reversal also left many trend-following strategies firmly in the red. Nevertheless, hedge funds remain on pace for their best calendar year performance since 2009.

With the US equity market trading sharply lower off an all-time high reached in late July, speculative-grade corporate bonds and leveraged loans experienced their first meaningful bout of spread widening of the calendar year. As with the S&P 500, the credit hedge fund index’s slight gain obscures the more significant underlying month-to-month moves; from July through September, credit hedge fund performance directionally tracked the S&P 500 Index, capturing between 20% and 40% of the equity market’s return. These results should be unsurprising given US high-yield debt has shown a significant positive historical correlation (0.59) with US equities over a 30-year period from 1987 to 2017.[2]S&P LCD calculated correlations between the monthly price returns of the ICE BofAML US High Yield Master Index II and the S&P 500 Index, respectively. Last quarter, the HFRI Credit Index gained 28 basis points (bps) in July, declined 53 bps in August, and then rebounded 35 bps in September. Besides fourth quarter 2018, which involved a significant pullback in credit markets alongside a major downdraft in equities, the credit index’s August retreat was its largest monthly decline since February 2016.

Securitized credit-focused hedge funds experienced a smoother quarter than those investing in corporate debt. The HFRI Relative Value: Fixed Income–Asset Backed Index and the Bloomberg Barclays Mortgage-Backed Securities Index—benchmarks that track hedge funds investing in asset-backed securities broadly and the performance of mortgage-backed securities, respectively—enjoyed positive returns in each month last quarter.

In this quarter’s edition, we will delve into recent credit market developments that contributed to the challenging environment for credit-focused hedge fund strategies. We will also discuss a few key sources of recent credit hedge fund volatility, namely general credit spread widening amid a broader bout of risk aversion, the Pacific Gas & Electric (PG&E) bankruptcy, and a surprising political development in Argentina.

Credit Spread Widening

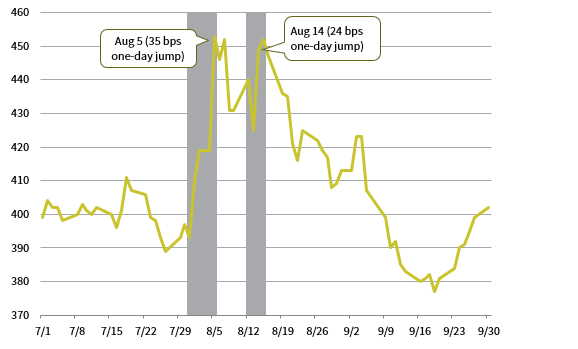

Beginning in late July, credit hedge funds began to suffer from general spread widening in corporate high-yield bond and leveraged loan markets in response to rising overall risk aversion. With high-yield bonds and bank debt making up the bulk of corporate credit–focused hedge funds’ long books, the overall downward pressure on bond and loan prices detracted from performance. Third quarter 2019 saw two big days for high-yield spread widening: August 5 (34 bps) and August 14 (24 bps). The August 5 move was the biggest one-day jump in the high-yield spread since the shocking “Leave” result of the United Kingdom’s Brexit referendum on June 23, 2016.

ICE BOFA MERRILL LYNCH US HIGH-YIELD OPTION-ADJUSTED SPREAD

July 1, 2019 – September 30, 2019 • Basis Points (bps)

Source: ICE BofA Merrill Lynch.

Notes: Data are daily. Gray bars represent periods where there was a notable increase in spreads.

For third quarter 2019, high-yield bonds rated CCC and lower—the riskiest of corporate credits—were down 2.3%, continuing a remarkable turnabout for CCCs in recent quarters. CCCs had enjoyed strong outperformance in the nearly three-year period leading up to the fourth quarter 2018 correction. Since the start of 2019, as the Federal Reserve has pivoted away from its earlier tightening path, the market has become somewhat more conservative. Investors have tilted toward higher-quality, more defensive plays, though have not abandoned the high-yield space altogether. Despite losses generated by the most speculative-grade issues, the broad high-yield bond index still managed to gain 1.2% for the quarter.

Pacific Gas & Electric

Hedge fund interest in PG&E ramped up late last year after the stock price plummeted over 60% following reports that malfunctioning company equipment had sparked a devastating wildfire (the 2018 Camp Fire) that began in Butte County, California, on November 8, 2018. The sell-off was in anticipation of billions of dollars in potential legal liabilities that the company—having already been found responsible for previous wildfires across northern California in 2017—could be ordered to pay out. As of December 31, 2018, PG&E’s Condensed Consolidated Balance Sheet estimated the total liabilities of wildfire-related claims to be $14.2 billion, and by June 30, 2019, additional claims submissions increased this estimate to $18.1 billion. The daunting scale of these liabilities led S&P Global and Moody’s to downgrade the company’s credit rating to sub-investment grade in early January 2019; later that month PG&E filed for Chapter 11 bankruptcy protection.

Following the company’s bankruptcy announcement, PG&E’s stock price traded up from the January low of $6.36 per share as investors concluded it was undervalued given optimism about a prospective restructuring. Credit hedge funds were eager to deploy capital given the limited corporate distressed opportunity set in recent years. Many funds took positions in the company’s equity, but some have been far more successful than others in trading around the subsequent headline-induced volatility; the company’s stock price appreciated as high as $24 per share in June but currently trades closer to $8 per share.

Many credit hedge funds supplemented their equity exposure with positions in the company’s bonds, some of which traded down to approximately 80 cents on the dollar during January. Most of the funds that have generated positive attribution from their PG&E positions year-to-date have tilted exposure away from the equity and into the debt. Additionally, several hedge funds have been able to attain unique exposure to the situation through purchasing subrogation claims or trade claims.[3]Subrogation claims are those filed by an insurance company against a third party to compensate a victim for damages. Trade claims are an unsecured obligation incurred by the debtor in exchange for … Continue reading These instruments are often purchased at a discount to corporate bonds but offer greater seniority in terms of the priority of payments; however, they are not widely traded and require robust sourcing capabilities to build a sizable position.

In early October, the US federal judge overseeing PG&E’s bankruptcy process ruled that the company’s board and management will no longer have exclusive rights to structure the terms of its reorganization. This is a favorable ruling for a competing restructuring plan designed by a group of PG&E creditors, including numerous hedge funds. Notably, the creditors’ plan would leave the business with very little equity value, while offering up to $14.5 billion in compensation to wildfire victims, compared to the company’s $8.4 billion proposed payout. While it remains unclear which restructuring plan will prevail, the company is incentivized to complete its bankruptcy process by June 2020 to be able to participate in a recently formed State of California fund to assist in funding future wildfire liabilities. Until then, it is likely that PG&E will remain a top position of credit hedge funds interested in monetizing this high-

profile bankruptcy situation.

Argentina

Another pain point for some credit hedge funds in third quarter 2019 involved Argentina. Several funds have held various positions in the country’s sovereign debt over the last two decades. Recent exposure to Argentina among credit hedge funds has been to low-dollar price Par notes, as well as Bonar (Bonds of the Argentine Republic) bonds. A presidential primary election took place on August 11 that witnessed the surprise landslide defeat of current Argentine president and market darling Mauricio Macri of the reformist PRO party by Alberto Fernández of the populist PJ party. Fernández captured 47% of the votes to Macri’s 32% share.

Fernández’s primary win generated significant market unrest given investor concerns regarding the candidate’s stance toward the country’s external debt. President Macri entered office four years ago as a market favorite based on his policy prescriptions for healing a wounded economy and his successful track record as mayor of Buenos Aires. In contrast, Fernández—a Peronist whose vice-presidential candidate is controversial former president Cristina Fernández de Kirchner—is a relative unknown next to Macri and Kirchner, and foreign investors feared the return of the interventionist policies from which the economy suffered under the latter. Investor concerns were further exacerbated by the Fernández camp’s lack of a formal, detailed policy platform, as well as the lack of an organized economic team despite the looming late October presidential elections.[4]Fernández and his populist PJ party subsequently defeated Macri’s reformist PRO party in the October 27 presidential elections.

Most critically, Argentina’s recent political gyrations have caused foreign investors to question the sustainability of the International Monetary Fund’s (IMF) $57 billion bailout program: Will the IMF cut off further aid with Fernández coming into power? As president, Macri had earned the confidence of the global capital markets, but Fernández could potentially reject previous agreements between the Argentine government and the IMF. Macri’s shocking primary loss shined a spotlight on the already deteriorating economic situation in the country, leading Macri to publicly contemplate restructuring Argentina’s debt, as well as instituting capital controls. Furthermore, the country is no stranger to such restructurings, having defaulted on its debt nine times in its history, including three times since 2000.

Following the surprise primary result, the Argentine peso depreciated by roughly 25% in the first day, and Argentine equities plunged more than 37% in peso terms (-48% in USD terms). The country’s sovereign debt suffered a similar decline; USD-denominated government bonds lost 25% on average, and the cost of credit default swaps referencing Argentine sovereign debt spiked.

Argentine bonds’ massive price swings during third quarter 2019 generally detracted from performance of credit hedge funds with Par and Bonar note exposure. In addition, some global macro hedge funds, as well as many emerging markets–focused strategies, were hurt by the simultaneous downdrafts suffered by the Argentine peso and—to a certain extent—Argentine equities.

Eric Costa, Managing Director

Adam Perez, Senior Investment Director

Patrick O’Donnell, Associate Investment Director

Footnotes