Global equity markets marched upward to start the year, and many indexes reached new all-time highs in late January, only to drop sharply when volatility returned with a vengeance beginning the last week of that month. An ensuing rally from mid-February through early March was short lived, as markets sank again to finish the quarter near their February lows. All told, US and global equities corrected close to 10% peak-to-trough during first quarter (in USD terms). The S&P 500 Index returned -0.8% for the full quarter, but this number masked the month-to-month volatility, as January’s 5.7% gain was more than offset by the loss of 6.1% over February and March. All but two S&P 500 sectors—information technology (3.5%) and consumer discretionary (3.1%)—finished first quarter in negative territory. Leading the retreat were telecommunications services (-7.5%), consumer staples (-7.1%), energy (-5.9%), and materials (-5.5%). US markets outperformed other developed markets; the MSCI World and STOXX 600 indexes returned -1.3% and -1.8% (in USD terms), respectively. Meanwhile, emerging markets maintained their relative strength from 2017: the MSCI Emerging Markets Index returned 1.4% (in USD).

In this quarter’s update, we look at the volatility and dispersion that broadly characterized the period for fundamental hedge fund strategies, while highlighting the churn that affected managed futures and particularly trend-following systems.

Fundamental Hedge Fund Strategies

Long/short and event-driven hedge fund strategies generated modest gains in first quarter; the HFRI Equity Hedge (Total) Index returned 0.6%, and the HFRI Event-Driven (Total) Index, 0.1%. According to Morgan Stanley, February 2018 was the first month in more than a year that hedge funds posted negative returns globally. March was the second, though fundamental hedge funds still outperformed many major global equity market indexes.

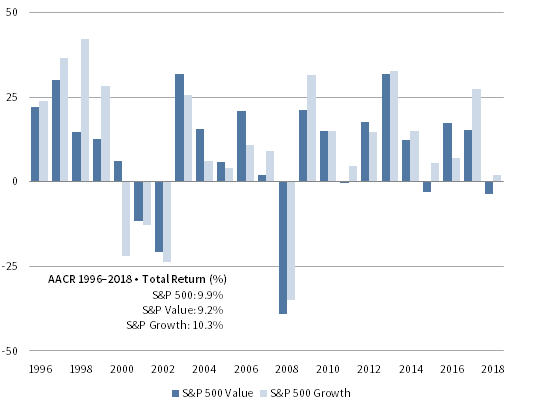

The managers we follow closely exhibited a wide dispersion of results during the quarter, owing to a number of factors. For example, the prospect of higher bond yields affected interest rate–sensitive securities, while the threat of tariffs and trade wars affected several industries. Value equities once again underperformed their growth counterparts: the S&P Value Index lagged the S&P Growth Index by approximately 550 basis points. Some value managers posted positive returns thanks to their short portfolios and certain idiosyncratic long positions that benefited from company-specific news. However, others suffered during the quarter—particularly those with exposure to energy, materials, and value equities in cyclical industries. Further, those value managers that were long value and short growth/momentum stocks were hurt on both sides of their portfolios during the quarter, with few places to hide.

Most growth-oriented long/short funds—especially those focusing on the technology/media/telecommunications and internet sectors—enjoyed positive returns during the quarter, owing mainly to a strong January. This was despite recent headlines putting pressure on technology leaders, such as President Trump’s tweets criticizing Amazon’s business model, the potential for Alphabet to face further antitrust fines by the European Union, and the data-privacy concerns and prospect of increased sector regulation that have beleaguered Facebook. Long/short managers with exposure to Facebook deduced from Google trends and application-use data that the impact of recent public scrutiny was likely to be short lived. Some increased their investments in technology leaders on the broader weakness in March, citing a belief that the looming regulation would take much longer to implement than market pricing suggested and would not be able to derail long-term secular trends.

Sources: Standard & Poor’s and Thomson Reuters Datastream.

Note: Data for 2018 are as of March 31.

Managed Futures

Managed futures strategies in general and trend-following systems in particular went on a wild ride in first quarter 2018. Commodity trading advisors (CTAs) and trend followers posted negative results as a whole, as evidenced by the Societe Generale (SG) CTA Index’s return of -2.8% and the SG Trend Index’s return of -3.9%. Fourth quarter 2017’s solid performance, which was predicated on synchronized global growth, continued into January on the back of strong trends in equities and commodities. Wage growth in January was higher than expected and sparked inflation fears; virtually every asset class then reversed, causing sharp losses for momentum-based strategies across markets. Those managers with greater allocations to mean reversion–based strategies generally outperformed the rest of the universe.

January was a strong month for most trend followers, although individual strategies’ performance ranged from relatively flat to positive double digits. The strongest results were driven by long positioning in equities and commodities, as a weak US dollar pushed prices upward. WTI crude was a top performer, and stronger signals prompted managers to take larger positions, leading to an overall increase in risk. Short positioning in agriculture was the only notable detractor for the month. Positive performance peaked around January 26, and the SG CTA and SG Trend Indexes returned 3.9% and 5.8%, respectively, by the end of that month.

The final days of January witnessed a sharp reversal that continued through the first full week of February. Almost every market suffered from the January 26 peak to the February 9 bottom; the SG CTA Index returned -10.3%, and the SG Trend Index returned -13.2%. The equities and commodities sectors led the decline, and short US dollar positioning also detracted. By and large, equity and energy markets lost the most in February, but no single market posted outsized losses. Rather, managers saw their ratios of winning to losing markets slip to roughly 20:80, with almost no positive trends to offset negative performance. March then offered managed futures strategies a welcome respite from the volatility, and their performance was essentially flat in the final month of the quarter.

Most managed futures funds ended first quarter carrying less risk than they had in mid-January. Dispersion among funds increased, especially in equities, as managers generally reduced their long exposure and in some cases added short positioning. Much of the universe remains short the US dollar and US rates, but long energy. Whereas trend systems are generally expected to produce positive long-term performance with low correlations to the broader markets, first quarter 2018 served as a reminder of their short-term variability with managers experiencing intra-month drawdowns of as much as 1.0 times target fund volatility as equity markets sold off. In light of the recent market turmoil and disappointing performance of managed futures strategies, we remind investors to maintain their long-term horizon as these strategies have historically protected during extended bear markets.