The fast-growing but still limited liquid alternatives product suite is unappealing today for most institutional investors, when compared to the broader hedge fund landscape. In certain limited instances the strategies could have a role to play in some portfolios:

- For investors with small pools of assets that cannot access hedge funds directly, liquid mutual fund products that invest in a hedge fund style may be more attractive than funds-of-hedge funds.

- For investors that had shunned hedge funds because of the lack of transparency and daily liquidity, liquid alternatives may hold some appeal.

- For investors that have outsized cash holdings because of a transition between two hedge fund managers, liquid alternatives might serve in a short-term placeholder role to keep strategy exposure during the transition.

- For investors that desire to gain some exposure to momentum or trend-following strategies, liquid alternatives using such techniques may be useful.

For many years, institutions have ramped up their exposure to hedge funds, despite onerous fees and limited liquidity. We believe investors that devote resources to the task may find skilled active managers executing strategies not widely available in other fund vehicles.[1]However, we believe the average hedge fund manager is very unlikely to be appealing. In fact, the fee structure of the industry almost guarantees this result. In recent years, hedge funds have seen some of their exclusivity challenged with the spread of mutual funds managed in hedge fund styles, providing individual investors or institutions with smaller asset bases with access to long/short equity, merger arbitrage, and other fund strategies. These “liquid alternatives” products include product types such as European UCITS vehicles, US mutual funds, and exchange-traded funds (ETFs).

In this short note, we introduce investors to some of the flavors of liquid alternatives, discuss some of the pros and cons and compare them to relevant hedge funds, and highlight a few of the potential uses for liquid alternatives. We generally find liquid alternatives unappealing for most investors; however, for some investors, certain liquid alternative strategies may have a role to play in portfolios.

Asset Growth Has Been Strong Since the Financial Crisis

While investors have largely turned to bonds in the wake of the financial crisis to provide portfolio ballast, the downward march of bond yields (and thus expectations for future returns) has encouraged a growing number of individual investors and their advisors to seek out hedge fund–style investments. Building a direct portfolio of individual hedge funds is well beyond the reach of the typical individual investor, given minimum investments that often start at $1 million. Mutual funds and ETFs, on the other hand, often have much smaller minimum investments, permitting investors to incorporate hedge fund–style strategies into smaller portfolios. The $600 billion liquid alternatives sector in the United States has grown at a 38% annualized pace since 2008, versus 9% for the US fund industry broadly, while in Europe the 30% annualized growth rate for alternative UCITS products far surpasses the 2% annualized growth for UCITS products as a whole. A recent McKinsey study forecasts that liquid alternatives will account for as much as half of the revenue growth within the retail-investor asset management sector over the next five years.[2]Please see McKinsey & Company, “The Trillion-Dollar Convergence: Capturing the Next Wave of Growth in Alternative Investments,” August 2014. For liquid alternatives to account for 50% of … Continue reading

Many Strategies Are Available in Liquid Formats

In the same way that “hedge fund” is a broad term that tells one very little about the strategy or economic exposures that a particular fund employs, “liquid alternative” tells one only that the fund is a mutual fund or ETF that follows a strategy that historically has been associated with hedge fund vehicles. These funds cover a wide variety of strategies, and some individual funds invest across several of them and may employ multiple managers. The rest of this section describes some of the strategies that liquid alternative funds employ.

Multi-manager mutual funds (akin to hedge funds-of-funds). The sponsors of multi-manager mutual funds typically hire a variety of underlying sub-advisors and ask each sub-advisor to manage a sleeve of the fund in a fully liquid version of the firm’s flagship hedge fund strategy. For example, a $1.8 billion mutual fund founded nine years ago currently employs 12 different sub-advisors, employing long/short equity and credit strategies, convertible arbitrage strategies, distressed debt, and other approaches. This is a popular style of liquid alternative product. Total product fees tend to be quite high, because both the sponsor and the sub-advisors receive substantial fee income. Theoretically this approach could provide investors with diversified exposure to hedge fund strategies, even if they are not able to build a portfolio of direct hedge funds. However, in practice, some of the managers on the lists of underlying sub-advisors are not particularly compelling, and investors should stay away from expensive, highly active managers unless they have great confidence in those managers.

Hedge fund replication strategies. The sponsors of funds and ETFs typically employ statistical analysis of recent returns of hedge fund indexes to determine what combination of financial market exposures might have produced returns that were highly correlated to the hedge fund index (generally examining the index’s returns to estimate the index’s underlying exposure). The replication fund would then employ those strategies during the following month, and then would re-do the analysis incorporating the most recent month’s data. For example, based on an index’s return signature through March, a replication fund might start April with a slug of small-cap equity exposure, some credit exposure, a bit of short exposure to commodities, and a smattering of equity put options. Because the approach is based on attempting to match the index’s pattern of trailing returns, this strategy is a constant game of catch-up. Additionally, while the management fees of these products vary widely, some of these products employ expensive underlying investments for their market exposures, using a high-fee ETF rather than futures, for example, to replicate equity exposure.

If these two reasons aren’t enough to make investors shy away, we would ask: what is the appeal of trying to match the return of a lackluster hedge fund index? Even if the hedge fund index’s return were available in guaranteed format, and without additional fees imposed by the replication firm (such as via a total return swap), this would be an unappealing investment. Out of the vast universe of hedge funds, only a small number of funds are well managed and worth investors’ consideration. Given that most are not particularly well managed and are very expensive, the indexes that are made up of them offer lackluster returns. The index return is likely to be unattractive relative to the return on a carefully chosen portfolio of established hedge fund managers. Investors seeking out hedge funds should be extremely selective, cherry-picking the best managers—and replication avoids that manager-selection process entirely.

A more promising style of a replication fund instead directly replicates a variety of hedge fund strategies in the manner of an index fund, such as by participating in all available merger arbitrage deals, systematically employing carry strategies across a broad sample of currency pairs, and executing other hedge fund strategies broadly. We know of at least one such fund that takes this approach, and it could be a reasonable option for investors seeking return characteristics broadly consistent with diversified hedge fund portfolios and that are limited to the use of expensive hedge funds-of-funds.

For more on this topic, please see Gene Lohmeyer et al., “Befriend the Trend: An Overview of Managed Futures Investing,” Cambridge Associates Research Report, 2014.

Managed futures funds and ETFs. These funds typically employ trend-following quantitative models to go long or short various investments, often including equities, bonds, currencies, and commodities. Trend-following and momentum strategies are backed by substantial research and have been employed successfully for decades by hedge funds and so-called commodity-trading advisors (CTAs). These strategies typically offer plentiful liquidity and capacity, and they are good candidates to be employed within a liquid vehicle.

That said, given the transparency required for liquid vehicles and their lack of a performance fee, managers may have little incentive to offer their most sophisticated trend-following strategy within a mutual fund format. The mutual fund versions might be thought of as a plain-vanilla approach. Still, these funds are worth considering even when investors could employ traditional hedge funds as there is no guarantee that a manager’s fully optimized trend-following strategy (and fully optimized fees) will trump the plain-vanilla strategy. Given the high turnover and leverage employed within these strategies, investors should ensure that the manager’s trading and risk management infrastructure are sophisticated and effective. A handful of liquid products employing trend-following or momentum are eminently recommendable; most are not.

Long/short equity strategies. These funds buy shares that they expect will outperform, and short shares they expect will underperform, typically ending up with some residual long equity exposure. Theoretically, managers of high-quality long/short equity hedge funds could expand their business by opening mutual fund vehicles, and perhaps limiting the portfolios to highly liquid securities. In practice, we have not seen the best quality managers do this. In part, this could be because top-quality managers are reluctant to offer some of their capacity without the promise of a performance fee. And in part, it could be due to concerns that periodic holdings transparency could make it difficult to build or unwind positions without impacting markets (particularly short positions). We don’t see many opportunities within this category of mutual funds at present.

Arbitrage and absolute-return strategies. This category includes funds that employ arbitrage strategies, such as merger arbitrage (buying the shares of a firm being acquired while shorting the shares of the acquirer) and convertible bond arbitrage (buying a convertible bond while shorting the issuer’s equity). While in theory lower-cost and liquid arbitrage products could be useful, capacity and available opportunities in these areas are somewhat limited, and in practice we have not seen many such products within a mutual fund format that are appealing.

Discretionary global macro strategies. In traditional hedge funds, global macro can mean a risk-controlled strategy employing multiple teams of traders, high leverage, and typically low or moderate directional market exposure. Or it can mean a swing-for-the-fences approach by a single manager or single team making aggressive bets on bond, commodity, currency, or equity markets, with plenty of beta exposure to various markets. The mutual funds categorized as global macro tend more toward the latter than the former. A handful of macro-oriented, multi-asset mutual funds may be worth considering. Investors that believe that global macro strategies will play defense in an equity rout should be aware that the mutual fund versions of global macro may be less suited to this role.

Summary. Given that liquid alternatives are competing directly with hedge funds in the above categories, direct comparisons of some characteristics are possible. That said, highly active managers are far from commoditized, so choosing based exclusively on objective criteria such as fees is not a viable approach. All things equal, by all means choose the lower fee option. But all things are rarely equal.

Comparing Liquid Alternatives and Hedge Funds

Fees: High and Higher. While typically fees for liquid alternatives products are much higher than for traditional stock and bond funds, they tend to be lower overall than the fees of hedge funds (in part because alternative-flavored mutual fund versions tend not to incorporate performance fees). Institutional investors might pay total fees of perhaps 50 bps for an active bond manager and 80 bps for an active equity manager. For an arbitrage-oriented mutual fund, they might pay 125 bps. And for an arbitrage-oriented hedge fund, they would pay a similar management fee plus a performance fee. Multi-manager products typically have some of the highest fees, because the sub-advisors add an additional layer of fees (this is true for multi-manager mutual funds, and for hedge funds-of-funds). Figure 1 shows the average fee for the largest mutual funds and hedge funds across four broad categories, from arbitrage strategies with relatively modest fees to multi-manager/funds-of-funds with deeply layered fees.

Figure 1. Average Management and Performance Fees of Large Hedge Funds and Liquid Alternative Funds

As of September 30, 2014

Because hedge funds typically have performance fees and most mutual funds do not, they can be difficult to compare. Figure 2 addresses this by starting with a hypothetical 15% gross return and then reducing this by the manager fees, to end up with an estimated net-of-fees return. Given a 15% gross return, hedge funds-of-funds and their underlying managers could extract a whopping 5 ppts of fees.[3]We have assumed in this illustration that the underlying hedge funds charge 1.5% management fees and a 15% performance fee.

Liquidity: blessing and curse. Daily liquidity (or even instant liquidity in the case of ETFs) offers investors much more flexibility. They can adjust their exposure whenever they choose, and the change will be reflected overnight, rather than 45 days later at quarter-end. But the liquidity that benefits one investor also benefits all other shareholders, and managers must prepare for the possibility that many investors redeem within a short period of time. For this reason, mutual fund managers must keep a lid on illiquidity in their portfolios, even when there is a much higher expected return available from assets with somewhat lower liquidity. While a hedge fund manager often has 45 days or more to raise cash to meet redemptions, mutual fund managers might receive significant redemption requests just as the markets are closing for the day. Because of this, mutual fund managers may have to spread their bets more widely, and may decide that the mutual fund versions of their strategy are inappropriate for some trades that are less liquid or that have limited capacity (such as commodity curve trades or shorting small-cap stocks). That said, we spoke with one manager that has both hedge fund and mutual fund versions of several strategies, and he confirmed that both fund types for a given strategy have a great deal of shared DNA and tend to be highly correlated, even when a handful of trades are omitted from the mutual fund vehicle.[4]He noted that regulatory considerations (such as the Investment Company Act of 1940—’40 Act in industry parlance—and the regulation governing UCITS products) do not generally limit the funds’ … Continue reading

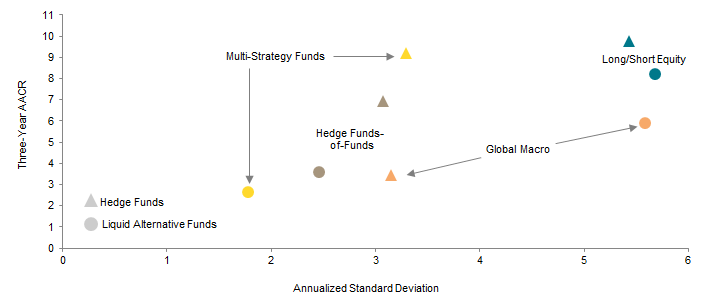

Early returns are not promising. As we noted earlier, returns for hedge fund indexes are not appealing; investors that don’t devote the resources to selecting managers that they believe will do much better should not bother with the asset class. We would expect this to be true of liquid alternative managers as a group as well, even though their fees are typically somewhat lower than those of hedge funds. And an initial look seems to bear this out. Figure 3 indicates that mutual fund versions of alternative strategies have tended to offer lower returns than their hedge fund counterparts.[5]Both the hedge fund category returns and the mutual fund indexes incorporate measures that should limit the effects of survivorship bias. In some cases, the mutual fund index includes some funds with … Continue reading

Figure 3. Comparing Risk and Return Across Hedge Fund and Liquid Alternative Strategies

As of September 30, 2014

The mutual fund versions of alternative strategies also tend to have higher levels of correlation to US equity markets than hedge fund versions (Figure 4), but the mutual funds’ beta is sometimes greater than hedge funds’ and sometimes less.[6]Mutual funds with higher correlation to equities can still have a lower beta, because of lower volatility. Hedge funds may also have lower levels of correlation in some cases because of stale … Continue reading Individual managers, of course, will offer returns that may differ sharply from these indexes and average returns—some will fare much better, while others will wither.

Figure 4. Correlation and Beta to S&P 500 for Hedge Funds and Liquid Alternative Funds

As of September 30, 2014

Unique benefits and drawbacks. Mutual fund versions of hedge fund strategies tend to have a somewhat lower overall fee drag than hedge funds. This is clearly a benefit to investors, ceteris paribus, but the lack of a performance fee may keep some managers away from the structure. Mutual fund versions offer daily liquidity, which is generally a benefit; this feature also constrains managers’ portfolio construction, and may make the fund susceptible to liquidity pressure, which can impact buy-and-hold investors, not just those that redeem. Mutual funds have stringent regulations, which may lower the risk of fraudulent transfers and Ponzi schemes. However, the regulatory burden may turn away some great managers, does nothing to stamp out incompetence, and does not prevent all types of malfeasance.[7]For example, about a decade ago, several prominent mutual fund firms were accused of allowing hedge funds to transact shares well after the market had closed but doing so at the market-close price, … Continue reading

Do Liquid Alternatives Have Any Appeal?

Whether they prefer hedge funds or mutual funds, investors seeking exposure to alternative strategies such as long/short equity or merger arbitrage must remember that manager selection is critical, and is likely more important than the selection of a particular sub–asset class or strategy. Today, hedge funds offer a somewhat larger pond in which investors can fish, with a larger number of investable products. Limiting the search to only liquid products is a significant constraint today, and we find liquid alternatives generally unappealing for institutional investors and families. That said, we know of a handful of liquid products that are excellent, and these funds can provide benefits in a handful of portfolio roles. For example, for investors with pools that are not large enough to incorporate direct hedge funds—which could include secondary pools like a supporting foundation of a larger endowment, or the younger generations of a family pool of assets—a well-selected smattering of liquid products may provide a return profile roughly similar to that of a diversified hedge fund portfolio, competitive with hedge funds-of-funds yet offering daily liquidity. For investors that are not comfortable with hedge funds’ limited transparency, which includes institutions with bond-ratings agencies or other outside entities that would prefer to limit exposure to somewhat opaque hedge funds, a well-chosen handful of liquid alternatives can offer strategy access, with full semi-annual position transparency. For investors that need short-term exposure (such as a pool that has redeemed from one hedge fund and received proceeds, and the replacement hedge fund manager does not accept new investments until a later date such as month-end or quarter-end), a liquid product that provides similar exposure may be preferable compared to keeping those proceeds in cash instead. Finally, for a portfolio that currently incorporates direct hedge funds but does not have exposure to managed futures, and that would benefit from additional liquidity to meet capital calls or to rebalance, among other reasons, a mutual fund focused on trend-following could be a useful addition.[8]There are several hedge funds offering a managed futures or trend-following strategy as well, perhaps in a more active form or incorporating more asset classes, and those products would be viable … Continue reading

Contributors

Sean McLaughlin, Managing Director

Eliza Van Buren, Assistant Manager, Manager Information

Alex Leiro, Investment Operations Associate

Michelle Wu, Investment Associate

Exhibit Notes

Average Management and Performance Fees of Large Hedge Funds and Liquid Alternative Funds

Sources: Cambridge Associates LLC and Morningstar, Inc.

Notes: The averages shown are for the largest ten products in each category within the Cambridge Associates and Morningstar databases. Fees for liquid alternative funds represent the total expense ratio. Fees for hedge funds represent the fee structure for investments in the fund’s lowest-cost share class. For hedge fund strategies, the multi-manager category represents funds-of-hedge funds (FOFs), and for these funds we have assumed that underlying managers levy a 1.5%/15% fee structure; the combined management fee shown is the sum of the FOF management fee and the assumed 1.5% underlying manager fee, while the combined performance fee compounds the assumed 15% underlying manager performance fee and any performance fee charged at the FOF level. The multi-manager and index replication funds category includes liquid alternative funds categorized by Morningstar as multi-alternative, as well as hedge funds categorized by Cambridge Associates as FOFs. The systematic/managed futures funds category includes liquid alternative funds categorized by Morningstar as managed futures, as well as hedge funds categorized by Cambridge Associates as systematic directional. The arbitrage/absolute return funds category includes liquid alternative funds categorized by Morningstar as market neutral, as well as hedge funds categorized by Cambridge Associates as either risk arbitrage or multi-strategy.

Average Large Hedge Fund and Liquid Alternative Fund Returns Net of Management and Performance Fees

Sources: Cambridge Associates LLC and Morningstar, Inc.

Notes: The multi-manager category of hedge funds represents funds-of-hedge funds, and for these funds we have assumed that underlying managers levy a 1.5%/15% fee structure; as well as any management and performance fees charged at the fund-of-funds level. The averages shown are for the largest ten products in each category within the Cambridge Associates and Morningstar databases.

Comparing Risk and Return Across Hedge Fund and Liquid Alternative Strategies

Sources: Cambridge Associates LLC and Lipper, a Thomson Reuters Company.

Notes: Fund data based on Lipper Indexes. Hedge funds-of-funds category includes funds categorized by Cambridge Associates as hedge funds-of-funds and by Lipper as absolute return. Multi-strategy funds category includes funds categorized by Cambridge Associates as multi-strategy and by Lipper as equity market neutral.

Correlation and Beta to S&P 500 for Hedge Funds and Liquid Alternative Funds

Sources: Cambridge Associates LLC, Lipper, a Thomson Reuters Company, and Standard & Poor’s.

Note: Data for liquid alternative funds based on Lipper indexes.

Footnotes