Ending 2015, hedge fund returns broadly were disappointing on an absolute basis and relative to equities (the HFRI Fund Weighted Composite returned a preliminary -1.0% for the year, while the S&P managed to eke out a 1.4% return). In this quarter’s publication, we review three of the crosscurrents that swept the hedge fund investment landscape and then delve more deeply into the event-driven space, which has now disappointed investors for two years running, examining some of the causes of poor performance and the prospects going forward.

Fourth Quarter Crosscurrents for Hedge Funds

First, the long-awaited and much debated tightening commenced with the US Federal Reserve raising the Fed Funds rate by 25 bps on December 16. The market reaction included rising rates—especially front-end rates—which led to yield-curve flattening. The one-year rate, one-year forward (1y1y) rose by 42 bps. The US Treasury’s two-, ten-, and 30-year cash rates rose by 42, 21, and 14 bps, respectively, while the rise in interest rate swaps was more muted; the 30-year swap rate rose by only 10 bps. This highlights two new, post–global financial crisis market dynamics. One is that China is beginning to sell portions of its gargantuan US Treasury holdings, sometimes through other central banks. Because US banks and dealers are now subject to much higher capital charges on holding inventory, the buying and bidding for China’s holdings has been tepid, leading to a rapid rise in yields. The other is underfunded pension funds’ need for duration, which has led to their receiving in interest rate swaps. Hence, the “inversion” of interest rate swaps, which now have lower yields than most Treasury bonds. Whereas the pre–September 30 inversion was only in maturities between 20 and 30 years, it has since moved in the curve to the point where all US Treasuries of three years or longer have higher yields than interest rate swaps. In effect, the risk-free rate for US Treasuries is now higher than bank liabilities. This strange and previously inconceivable phenomenon is not likely to reverse anytime soon.

Second, China’s shift from a manufacturing- and capital expenditure–led economy to a consumer-led one continues to be both a global risk and an opportunity. The US dollar remains strong, especially as it represents the only G3 central bank that has graduated from quantitative easing to tightening interest rates. Both the euro and Japanese yen were largely unchanged, while the People’s Bank of China devalued the renminbi by another 3%, taking with it all China- and commodity-dependent currencies (i.e., the AUD, BRL, CAD, NZD, THB, VND, and ZAR). The oft-referred-to “mountain” of Chinese debt remains a regional credit risk and a threat to global growth.

Finally, the energy complex and, with it, the whole commodity space are, as of this writing, still in free fall. Seasoned pundits are no longer attempting to call a bottom, and the credit space is littered with funds that bought energy exposure—loans, bonds, etc.—too early. As of this writing, a barrel of crude is down nearly 75% since mid-2014 and 45% since the start of 2015. And, as mentioned earlier, the ability to warehouse/finance securities is severely constrained by newly imposed capital charges, which, in turn, has severely impacted liquidity for funds that assumed better liquidity (e.g., Third Avenue Management’s mutual fund) and those whose status is predicated on overnight liquidity (e.g., exchange-traded funds).

Event-Driven Strategies in Focus

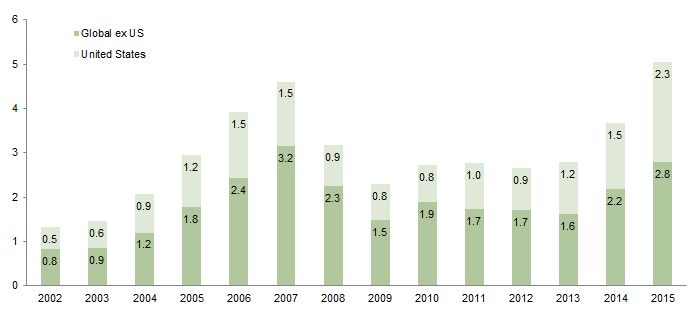

Over the past several years, we have expected an increase in corporate activity to lead to attractive opportunities for talented event-driven managers. Part of that expectation has proved correct. Corporate activity had a banner year in 2015, led by a record-shattering $5.1 trillion worth of global mergers & acquisitions (M&A). This easily surpassed the previous record, $4.6 trillion in 2007, and represented an increase of more than 38% from 2014 levels, according to Dealogic. M&A activity was robust around the world; while the United States represented roughly half of announced activity, the Asia Pacific region also exceeded $1.0 trillion for the first time in history. A key factor in the surging activity was the record number of mega-deals—mergers of $10 billion or more—which totaled 69 and represented more than $1.9 trillion in value. Corporate activity was also up outside of M&A: spin-offs, another favorite hunting ground for event-driven hedge fund managers, totaled more than $256 billion in 2015—another record, according to Dealogic.

This clear surge in corporate activity provided what would seem, at least on the surface, a singularly attractive opportunity set for event-driven managers to sift through. Unfortunately, the strategy’s return profile over the last 18 months has been frustratingly and surprisingly poor for most managers in the event-driven space. As detailed in our year-end 2014 update, a handful of events in the fourth quarter of that year cost many managers dearly: the Fannie Mae/Freddie Mac ruling, the collapse of the AbbVie/Shire PLC deal, and the beginning of the rout in energy commodities. The HFRI Event Driven Index returned -1.4% in fourth quarter 2014, but still generated a small profit of 1.1% for the year. Event-driven returns were particularly disappointing relative to the S&P 500, which returned 13.7% in 2014.

Source: Dealogic.

Notes: Dealogic updates its database on a regular basis; therefore, historical data may change. Data for 2015 are as of December 31.

Returns in 2015 were even worse for the strategy. The HFRI Event Driven Index returned -3.3% for 2015 and, for the seventh consecutive year, failed to outperform the S&P 500. This trend has led to a meaningful spread in the two indexes’ cumulative returns over that time: 163.0% for the S&P 500 compared to 62.6% for the HFRI Event Driven.

One of the key drivers of the poor performance throughout the event-driven space was the challenging regulatory environment in M&A. According to the Dechert Antitrust Merger Investigation Timing Tracker, significant antitrust merger investigations in the United States took over one-third longer to complete in 2015, on average, than they had two years prior. Prolonging a merger’s completion time reduces the expected internal rate of return (IRR) for an arbitrageur, so this trend lowered returns across the strategy.

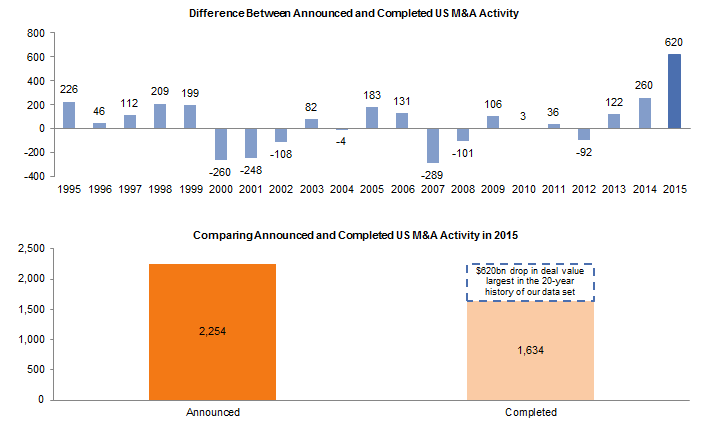

In addition, the number of investigations increased by more than 30% year-over-year, leading to several high-profile deal cancellations. Of note, the Comcast/Time Warner Cable and Applied Materials/Tokyo Electron deal breaks together destroyed approximately $54 billion in value. The important distinction between the extension of deal time and the breaking of deals is that one lowers the expected IRR, whereas the other results in permanent capital impairment. As the figure below shows, 2015 was clearly an outlier in terms of the amount of announced deal value left uncompleted.

Source: Dealogic.

Notes: Announcements are based on deal acquirer nationality. Completed data include cross-border activity. Dealogic updates its database on a regular basis; therefore, historical data may change. Data for 2015 are as of December 31.

Ultimately, the combination of lowered IRRs and several broken high-profile deals should result in capital fleeing the space. Event-driven managers that can withstand mark-to-market volatility should find this situation compelling, as reduced capital deployed to event-driven situations will lead to more attractive long-term returns.

Other headwinds to event-driven returns included the aforementioned downward price pressure across the energy and commodity space and meaningful deterioration of liquidity in the credit market, as well as the continued underperformance of value (which is highly correlated to event-driven investing) relative to growth.

Looking ahead, managers facing their second year of frustrating performance—including some with meaningful negative two-year results—are likely to experience organizational pressure, a trend we have observed increasingly in recent weeks. The greatest issues are likely to befall funds with weaker capital bases—those that either have poorly or inadequately matched assets and liabilities, or that have taken capital from short term–oriented investors and/or investors facing their own funding pressures (e.g., funds-of-hedge-funds experiencing redemptions). These problems typically manifest as increasing redemptions, voluntarily and involuntarily reduced headcount, and other business pressures.

While the last several years have generated frustrating returns in the event-driven space, we have no reason to believe that the landscape has changed in a manner that will leave the strategy structurally ineffective. Event-driven investors take advantage of price dislocations—based on fundamental analysis of various corporate events—that occur because of timing, complexity, and various other market inefficiencies, all of which still exist. Companies will still merge, spin off divisions, and go through bankruptcy. All investment strategies tend to exhibit some cyclicality, shifting into and out of favor (such as long/short equity after the risk-on/risk-off environment of 2010 and 2011). We believe that capital exiting the strategy today is selling low, thereby crystalizing temporary mark-to-market losses, and we continue to believe in the viability of event-driven investing. If anything, decreased capital in pursuit of opportunities should enhance returns for the remaining players. As always, the key is to identify talented managers with both the investing acumen to navigate the challenging markets and well-constructed businesses that allow them to continue playing offense while others play defense.